You can become rejected for an effective Va financing, even although you meet up with the government’s minimum advice to possess system qualification. Conference the Department’s standards is not adequate. They are the vital circumstances with respect to being qualified to possess a beneficial Va loan now.

Va Credit ratings: As previously mentioned earlier, this new Agencies regarding Experts Activities doesn’t have certain requirements to have credit scores. You could remember the lender does, and this may differ from one financial to a higher. Really banking companies and loan providers need a credit history regarding 600 to get acknowledged. Yet not, this won’t ensure mortgage recognition and there is wishing attacks having candidates with present financial https://clickcashadvance.com/payday-loans-tx/ hardships like foreclosures, case of bankruptcy, etc.

Records required for Va investment normally include the Certificate regarding Qualification (COE), the Consistent Domestic Loan application (URLA), financial statements, tax statements and W-2 variations, the new DD Mode 214 to have veterans that have kept the army, and you can some standard Virtual assistant documents

The minimum credit conditions together with trust the fresh new downpayment number. If the a debtor cash 100% the credit requisite was more than a debtor who may have a good 5% otherwise 10% down-payment. On the other hand, some individuals which have low personal debt, an such like is acknowledged having a bit faster credit ratings.

Va A career Records: Like most home loans today, Virtual assistant will require a steady two-seasons a career records no higher holidays from inside the a position

Modifying companies is normally okay, so long as there clearly was no high pit from 1 occupations to the next. Borrowers you to discovered strictly impairment otherwise personal safety income is exempt from this rule. However, they need to provide enough papers delivering continuance of such income.

Va Debt-To-Income rates: The fresh Virtual assistant obligations-to-earnings proportion, or DTI, is another very important Va loan requisite. This is an evaluation between the sum of money you earn (disgusting month-to-month earnings) and also the matter you to goes toward their fixed month-to-month expenditures (repeating costs). Generally speaking, your complete DTI proportion, including the household payment, must not meet or exceed 43%.

So it requisite is implemented from the lender, not from the Va. Which differs from that mortgage company to another. Conditions usually are created for borrowers that have higher level borrowing, extreme deals throughout the lender, etc. Loan providers and agents telephone call such strong compensating factors of one’s loan Money can come off a number of source including but not limited to foot armed forces spend, non-army a position, income, self-employed income (minute 2-year records) advancing years earnings, spouse’s earnings, and you will alimony.

Va Mortgage Records: With respect to Va mortgage standards, files is key. Financial institutions and loan providers commonly consult a wide variety of records to ensure your earnings and you will possessions, and your latest financial obligation condition. Nevertheless they need to make sure and you will file what you can do to repay the mortgage, in line with the new credit requirements. If you want direction looking for these files, we are able to assist. Only e mail us all week long.

Virtual assistant Occupancy (Top Residential property): The new Va also has specific requirements to possess occupancy condition. This means that, you must use the family since your pri to finance the fresh acquisition of an investment or travel (next household) property.

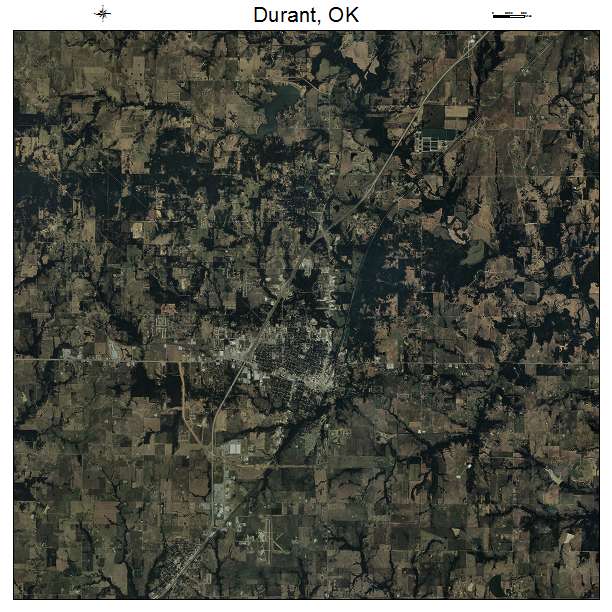

Va Assessment: Just like any almost every other financial program, the fresh new Institution away from Veterans Things needs all belongings becoming ordered with a beneficial Va mortgage to endure a home assessment. And here a licensed appraiser evaluates the house to choose simply how much its value in the current sector. Usually, our house must be really worth the count you may have wanted to shell out the dough, therefore dont exceed the newest Va mortgage limit towards state in which its found. Our home should be sufficient guarantee toward requested loan, according to the Institution. Please call us to talk about this new Va loan buy limit into the your own town.