Just after calculating his ages and you will value of , the husband is advised he can open thirty-five% from their residence’s well worth that have a security release plan. To spend his partner an entire 50%, the guy accounts for the newest shortfall having fun with his or her own savings.

New couple’s guarantee discharge and you can divorce or separation solicitors come together to arrange the plan and take away the new wife’s name regarding the name deeds. After over, the fresh new equity release solicitor transfers the bucks in to their unique membership.

Plus the mental and economic pressures to find an effective new house immediately after a separation, today’s later lifestyle divorcees who require to move household will get face intense race off their consumers. Very sought after, well-handled property can be expensive and you may commonly get purchased easily.

When you are desperate for a property affordable after a splitting up, it might be worthy of examining equity launch to help buy your next household. This can be done by using a mix of this new deals arises from the fresh new marital household and you will people discounts you have, together with money raised of a collateral discharge anticipate their new house.

Example: having fun with collateral release to purchase an alternative assets

A couple within very early-seventies initiate divorce or separation and you will concur that neither of them would you like to to save the household household. They promote its shared assets and this introduces them ?440,000 or ?220,000 each.

New partner discovers a house and therefore she can pay for using their particular share of one’s money from the house business. But not, the latest husband is unable to come across some thing compatible because finances. The guy do not find an excellent possessions getting ?320,000.

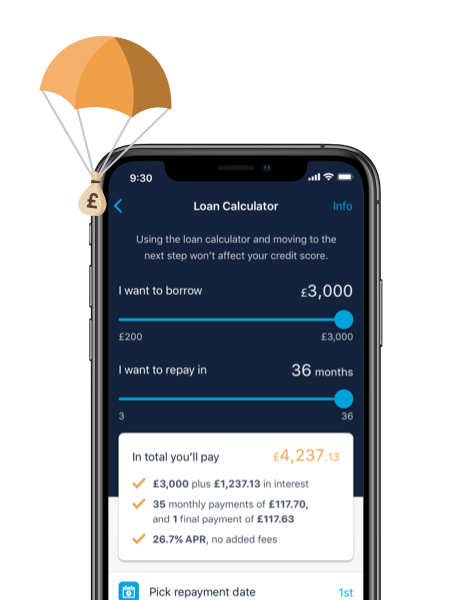

Due to their pension earnings being 71 yrs old, the guy finds out that he is unable to safer a mortgage towards his the property adequate so you’re able to connection the latest ?100,000 shortfall. Just after offered every one of his solutions, he decides to program a guarantee launch intend to support loans Ashford AL the purchase of their new house.

With his guarantee discharge adviser and you can a professional solicitor, he releases ?100,000 out of their new house to get for the purchase of it. He has no month-to-month payments and work out, when the guy dies, his home is sold as well as the financing also desire is reduced in full.

Collateral discharge is normally meant to be an existence connection, therefore is not usually reduced before history surviving citizen passes away otherwise moves on long-title care. Although not, there are things in case the plan must be up-to-date or perhaps avoid very early divorce case getting one of them.

For many who plus partner currently have collateral launch and splitting up , try to get hold of your bundle provider to own recommendations regarding your plan.

What goes on if one companion provides our house?

Say your lady otherwise companion movements away while plan to need full possession of the house. Immediately following alerting the plan supplier of changes, your favorite solicitor is also modify the latest property’s title deeds so you can reflect the unmarried control. The latest security release plan will remain on your name only if you don’t pass away otherwise move into much time-label worry.

What takes place if for example the house is offered?

If you choose to promote your house within your divorce settlement you might end their bundle early. You are doing which by the contacting the lender and requesting to settle the mortgage completely. Might let you know about the past settlement contour that’ll are any attention and you will early repayment charge due.

Instead, among you might vent (move) the decide to your new family in your best term, bringing your new possessions fits your lender’s requirements.