Whenever you are an eligible veteran otherwise servicemember given an excellent Va domestic loan, you have read cam regarding a termite examination requirement. However, why you will the latest Service from Experts Things (VA) need a termite review and just how does the procedure works? Regardless if you are selling or buying a house, this is what you need to know throughout the pest checks for Va money.

What’s a Virtual assistant mortgage pest examination?

Good Va termite examination may be required while you are to shop for a house or apartment with a good Va financing. Within the a termite evaluation, an experienced elite explores the home to possess insects and you can signs of timber ruin. This is to ensure the coverage and you can ethics of the property.

Remember that pest monitors to own Va financing may go by a number of names. You can also find them called WDO (wood-damaging organism) or WDI (wood-destroying bug) monitors. Installing, given the military’s passion to have acronyms.

What makes a pest assessment necessary?

In addition to being a nuisance, pest ruin shall be expensive. Lesser ruin can sometimes be repaired seemingly inexpensively, however, large infestations might cost way more to relieve. Termite infestations have the possibility to change the value of property if you don’t managed.

Are good Va mortgage termite review required in every condition?

Since termites be preferred in certain regions of this new U.S. as opposed to others, pest evaluation requirements have a tendency to are different by state, and sometimes even by county. More over, these criteria are susceptible to transform, therefore it is generally value shopping around to ascertain and therefore criteria apply at Virtual assistant loans near you.

No matter place, an effective Virtual assistant pest check is almost always required when the proof of wood-ruining damage from insects are detailed on independent appraisal that Virtual assistant alone demands.

Why does the newest Va decide which parts need termite monitors?

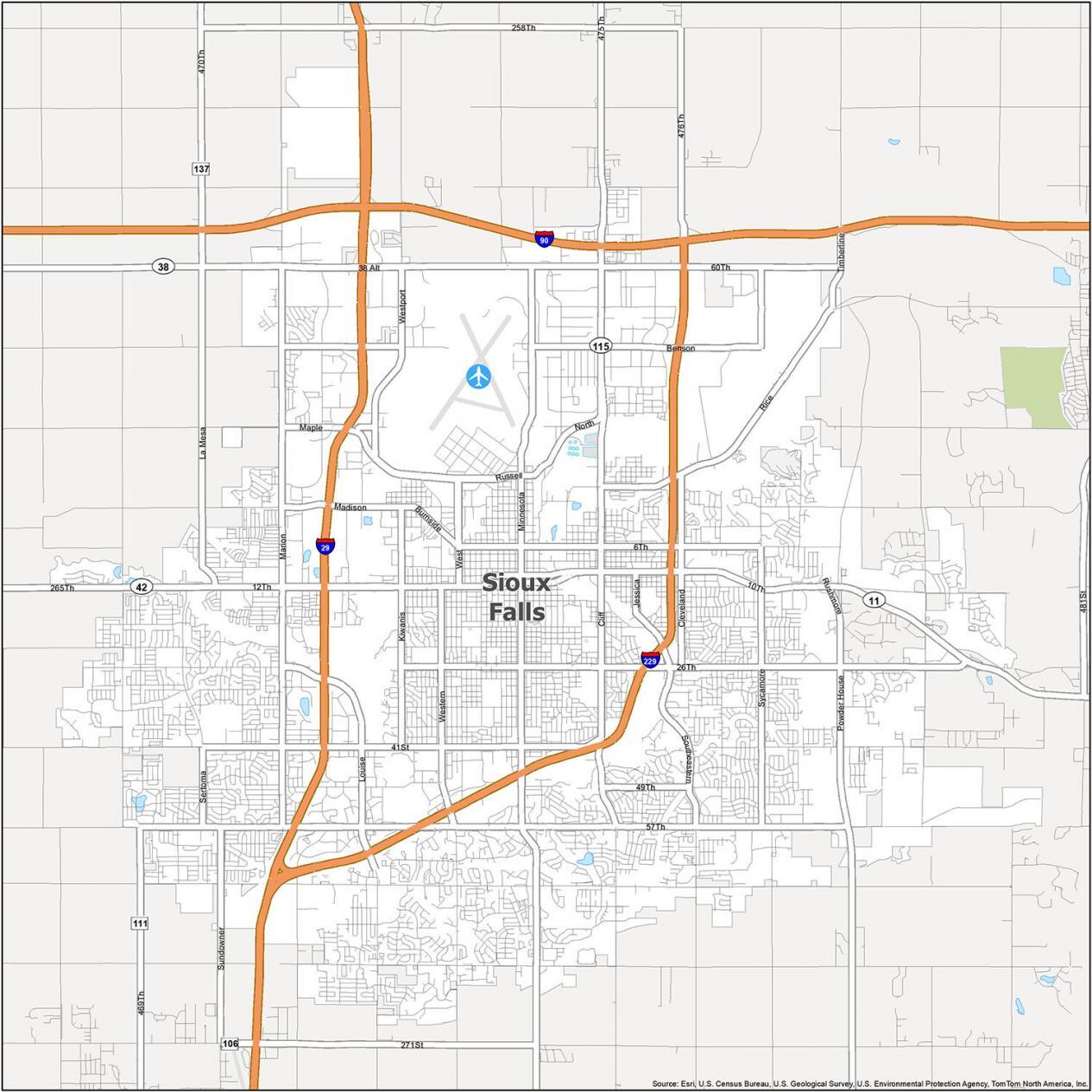

The latest Virtual assistant relies on what exactly is named a termite Infestation Likelihood Chart, exhibiting which regions in america try very likely to termites. It map are sometimes upgraded, and inspections are usually necessary for any elements that have good moderate to help you heavier otherwise most big likelihood of pest infestation. A complete listing of claims and areas that require termite checks can be obtained for the Virtual assistant site.

Next conditions to have Virtual assistant pest checks

Even though many claims require pest checks to have Virtual assistant financing, they aren’t compulsory for everybody Virtual assistant mortgage issues. Such as, termite checks generally commonly required for Virtual assistant streamline financing, known as IRRRLs (Rate of interest Avoidance Re-finance Loans), financing merchandise that will make refinancing shorter and sensible to have veterans.

Va pest assessment vs. Virtual assistant appraisals

Va pest monitors shouldn’t be mistaken for Va appraisals. A great Va appraisal, you’ll need for all Va loan get, try an over-all evaluation out of an excellent home’s worthy of and updates transmitted out-by an independent appraiser authorized by the Virtual assistant.

Who will pay for an excellent Virtual assistant pest check?

It used to be that people just who pick a property having an effective Va loan was basically generally speaking prohibited off purchasing the latest pest examination on their own.

Although not, Virtual assistant pest check criteria was basically loosened during the 2022 allowing all the borrowers to fund checks. So it change was partially on account of questions one demanding sellers to help you purchase the brand new pest review is actually a possible reason for rubbing during the to shop for process. The price of checks basically varies by sized the new home and exactly how extensive this new check is.

Why does good Va pest assessment functions?

In the a pest review having a beneficial Virtual assistant loan, an experienced inspector visits our home and you will explores the exterior and you can, accessible areas of the within, plus attics and you may spider spaces. Brand new inspector actively seeks signs and symptoms of wood-destroying insects such termites and you may carpenter ants. Signs could be pest sightings, wood destroy within the or around the home and you can bug droppings.

A pest assessment having a Va mortgage will usually find more than just termites, yet not for all insects. Brand new Va pest check is limited to those people bugs which end in wood wreck, instance termites, powderpost beetles, carpenter bees and carpenter ants. However, when your inspector notices other problems, eg an issue with most other bugs otherwise that have rats, they could mean this throughout the payday loans Mount Olive declaration, also one features which might result in the assets at risk of infestation.

Termite all about home inspections are usually valid to have 90 days, making it possible for the consumer time and energy to complete the closing procedure. Keep in mind that that it validity screen is for this new Va loan procedure and won’t make certain that insects wouldn’t arrive in the house amongst the review along with your flow-in time. The specific style of your own inspector’s report can differ by the county.

What takes place in the event that property fails their Va pest assessment?

If the possessions you want to buy goes wrong the Va pest inspection, the problem must be managed. The fresh new inspection report will comes with pointers and you may suggestions away from treatment.

In terms of which assumes the brand new fix cost, this may vary from the condition. In a few says, it may be around the customer, while most other claims need vendors or loan providers to help you lead upwards so you’re able to a quantity. Anyway, the Va prompts the customer to discuss for the merchant more than fix will set you back.

The bottom line is

The goal of Virtual assistant home loans is always to assist render secure and you may sanitary houses having solution participants, veterans and you may eligible survivors. Inside the areas where infestations are common, a great Va mortgage pest evaluation is usually expected to make certain your house is free out of potentially high priced insects. As conditions can vary of the state, it’s worth looking at the Virtual assistant webpages or talking-to your own real estate professional to choose whether termite checks are essential to own Va money towards you.