A beneficial personal debt-to-earnings proportion

It will be the number of loans you may have versus your income. Loan providers use your debt-to-earnings proportion to choose whether you will end up attending pay their costs on them.

To determine what your loans-to-income proportion is actually, sound right your ongoing monthly payments. Minimum credit card payments, book, auto loans, and you can student education loans. Simply consider your lowest repayments, perhaps not extent your debt. Incorporate all of them up and divide they by the terrible monthly income (prior to taxes or any other write-offs). It’s your obligations-to-income proportion and it’s really created since a share.

Because the example, should you have an excellent $step one,100 month-to-month car repayment, $3 hundred minimal cards commission, and you will $300 minimum college student personal debt fee, your own complete monthly bills would be $1,700. If your month-to-month earnings is $5,000, the DTI proportion will be step 1,700/5,000 = 0.34. 0.34 x 100 = 34. The DTI would-be a very suit 34%.

DTI scoresYour lender’s most significant issue is whether or not you could pay off the mortgage. Their DTI rating is amongst the computations they use to help pick. They’ll as well as look at the FICO rating, work record, income, possessions, and much more.

At least, they want to visit your proportion lower than 50%. It is ideal having your closer to thirty five%, but range between them is acceptable.

Mediocre financial obligation for each and every AmericanIt’s difficult to tell just what the average DTI proportion try, but we can say what the mediocre amount of loans try. An effective 2021 CNBC statement calculated the common Western provides $90,460 in debt. Including the playing cards, unsecured loans, mortgage loans, and you may college student financial obligation. The better a person’s money, the greater its personal debt (plus the much easier it is so they are able pay-off).

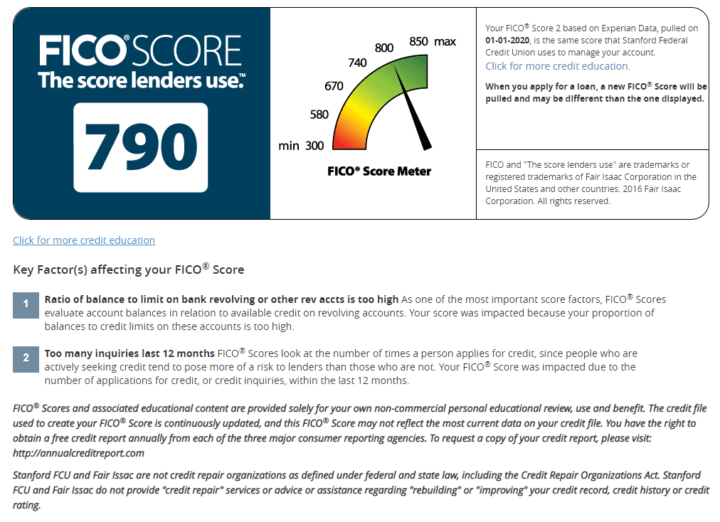

Usually do not apply for the latest creditApplying for brand new borrowing from the bank usually lower your credit rating and you can, if you’re acknowledged, increase your personal debt-to-earnings ratio a switch factor lenders think once you apply for a home loan

Cutting your DTIThere are only a couple of a means to get it done. Decrease your monthly expenses otherwise increase your month-to-month earnings. Both options needs time to work and effort however, pay off during the the future.

In lieu of looking at your if the DTI is just too highest, thought talking-to your property lender to talk about they together. Local household lenders, including Mann Mortgage, often feedback your DTI and you will help as well as your unique monetary choice to find the right financing.

Even though you are pre-recognized for a financial loan does not always mean you might be going to rating last acceptance in your mortgage. If your promote has been acknowledged and it is for you personally to begin closing on your own financing, their home loan company is just about to capture a new intricate take a look at your credit report, assets, money, and FICO get. We need to make sure you look coequally as good as you did the afternoon you have pre-acknowledged. How do you accomplish that?

Never miss paymentsThey’re likely to determine whether you have been later or overlooked one payments on your credit cards or funds because you was pre-accepted. A single 30-go out later fee normally negatively feeling your credit history by many situations. Make sure you have all the medical debts, vehicle parking tickets, and you will electric bills right up-to-date and you will repaid also!

instant same day payday loans online Nebraska

You should never transform jobsThis could well be out of your control, however it is far better stick to the work you had whenever you’d the loan pre-acceptance. Switching operate you will rule a modification of earnings, and that ount you may be approved to borrow.

Never make large purchasesYou was tempted to begin shopping for seats otherwise appliances for the new house, nevertheless ought not to do so. For folks who place the fees on the credit card, your debt-to-income proportion varies. Of course you have to pay dollars, you’ll have less cash having a down payment or since an asset. Wait into the one higher commands up to you have signed in your brand new home!