Product sales and you will profit margins of numerous micro, quick, and typical-measurements of enterprises (MSMEs) try very at risk of seasonality, input and labor will set you back, later payments, absolute disasters, unanticipated expenditures, and you may myriad additional factors you to definitely result in lumpy cash streams. Rather than collateral or adequate borrowing information, banking institutions are usually reluctant to lend her or him money, thus this type of MSMEs face the additional risk of non-carrying out property.

However, as a result of the brand new technology, new psychology regarding loan providers is evolving with techniques that will be enabling MSMEs to access loans.

These loans are entirely different from traditional investment-backed funds, the spot where the valuation away from collaterals offered to the financial institution ount and you will tenor. The latest reticence out-of antique banks so you’re able to provide to help you MSMEs relies on that they don’t really provides fixed assets given that collateral.

Emerging monetary technical (fintech) professionals in the world was reshaping just how MSMEs can access doing work financial support and money disperse loans.

After all, cash is truly the only factor that normally pay back a loan; security is only the 2nd way-out if the money cannot be produced.

[tweet=”ADB’s : Earnings-situated financing assist #MSMEs supply borrowing instead guarantee #fintech” text=”Earnings-depending loans let MSMEs availability borrowing from the bank in the place of collateral”]

An illustration is actually Kenyan merchant pay day loan services Grow, which helps MSMEs supply money from the factoring their funds disperse cycles when you find yourself at the same time promising these to initiate getting off dollars in order to electronic costs account via the Kopo Kopo exchange system.

A portion of your electronic transactions one merchants discover is determined aside to repay their improves. Which plan enjoys payments liquid, bite-sized, and also in line which have income.

From inside the Asia, Financial support Float, a non-lender monetary institution, brings quick decisions to your security-totally free funds to own brief entrepreneurs. A risk reputation assessment is performed in real time from the examining MSMEs’ dollars flows playing with analysis of PayTM, an e-business payment system and you can digital purse business, mobile financial qualities corporation PayWorld, and you will cell phones.

Financing Drift consumers do electronic discover-your-buyers (KYC) authentication, have the financing promote, prove greet, and you can sign the mortgage agreement into the a cellular app. The mortgage matter try credited on the account on a single date, having nil papers.

Income financing let MSMEs seize options when they arise, and are an excellent example of the latest focused, specific niche creativity which allows fintech so you’re able to contend with far more prominent-however, much slower-antique banking companies. He’s perfect to help you firms that look after quite high margins, however, run out of sufficient difficult possessions to offer as security.

[tweet=”#Fintech people fighting with finance companies on the targeted, market designs ADB’s #MSMEs” text=”Fintech companies fighting which have finance companies into the targeted, niche innovations”]

These types of funds generally serve MSMEs in selling and sale, in which controlling and you can promoting top cash flow is extremely important offered the more expensive off personal debt and lower go back toward investment than the large firms.

Discover a growing pattern of cash circulate-mainly based capital supported by latest and you will estimated future bucks circulates

Rural credit is additionally shifting with the earnings-founded lending, that will keep costs down and you may focus larger finance companies and you will loan providers. Fintech provider team such as for example India’s CropIn Technical is bringing analysis, fake intelligence, and you can server learning to financial institutions to help them most useful assess borrowing chance.

Character study towards the KYC, geo-coordinates of farms, reputation of vegetation he’s got sown, harvest size, give and you may prospective money grounds for the mate bank’s digital system. This post is collated having secluded-sensing studies in order to predict good farmer’s returns, rates of your own yield, and you may price point.

The final action was plotting risk scores for growers having fun with an effective machine-learning algorithm. From the examining the cost of type in/production, positive income and you may profitability, instantaneous credit disbursal can be produced in the rural areas.

Adopting the loan could have been approved, satellite photographs support the bank perform secluded keeping track of and analysis by providing unexpected investigation to the whether the farmer has used the brand new disbursed loan into the meant objective. If crop tactics the new accumulate stage, the bank is actually notified to get in touch towards character in order to start the latest cost processes.

Insurance agencies seeking offer pick coverage to help you smallholder farmers can be in addition to leverage such as technology to own underwriting and states government. On the dairy market, with are now able to money bucks flows from the determining the level of settlement payable so you can a character centered on both wide variety and you will top-notch whole milk produced.

More regular costs line up into character of money disperse credit while the exposure policies out-of fintech lenders. It involves real-date earnings-situated underwriting and you can tabs on highly leveraged harmony sheet sets, playing with most recent membership and seller settlement data to the considerable amounts out-of short repayments. The borrowed funds dimensions and rates depend on the amount and you will balances of money moves.

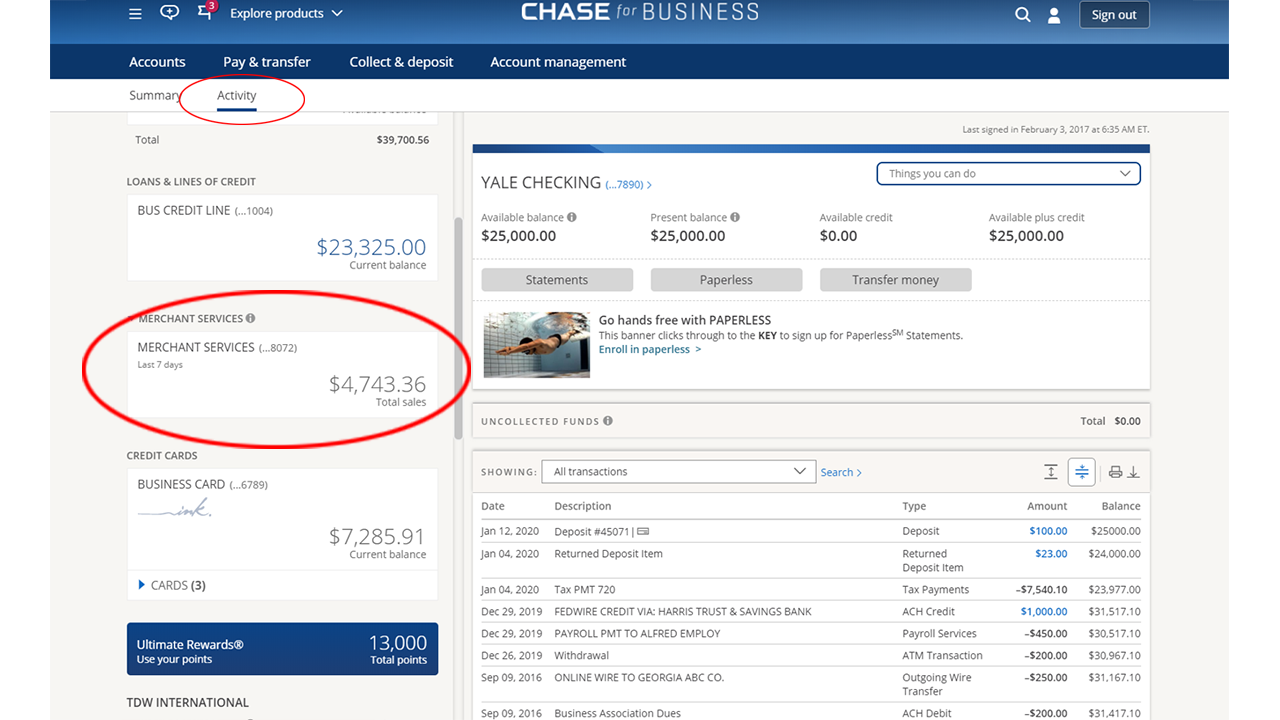

Just like the MSMEs normally have a single checking account, using very automated cost and you can decision motors brings an obvious digital footprint to have tracing a brief history of the dollars circulates. From the looking at the online cash streams, an exact and you can genuine-go out risk comparison of one’s quick-title economic wellness off MSMEs can be produced on the repayment capability and you may exchangeability standing.

Which have acknowledged one consolidate debt MSMEs lack the power to build financial profile make it possible for creditors to evaluate the repayment capability and default exposure, they are deploying agile and nimble development to track down an accurate understanding of their cash transformation cycle

Accessibility genuine-time recommendations helps to perform chance, whilst allows the financial institution to recognize new defaulting MSME quickly and ring-barrier the cash streams otherwise suspend money ahead of delinquent fees accrue. It renders no room to possess control out-of financing a root problem of resource-supported financing actions that suffer diversion of money streams using multiple bank accounts.

With a new generation of electronic-smart MSME customers emerging into the development Asia, conventional users will get soon find themselves to experience second fiddle to fintech. The only method to endure is always to innovate in the MSME financing place and you may accelerate capital from inside the technology so you can coming-facts their networks and you may retain and you may develop their low-old-fashioned customers.