The fresh creating limit for those notes ranges on the reasonable various, with no origination fee on the having the cards. These notes report to the three major credit agencies, that is high since it makes you rebuild their borrowing from the bank if you are paying their statement punctually and not surpassing that borrowing from the bank restriction.

This type of notes are great as they bring people the chance to hold a bona fide mastercard and use one to to shop for stamina whenever called for. When take a trip, you can use the brand new card everywhere Charge card try recognized, in addition to international locations.

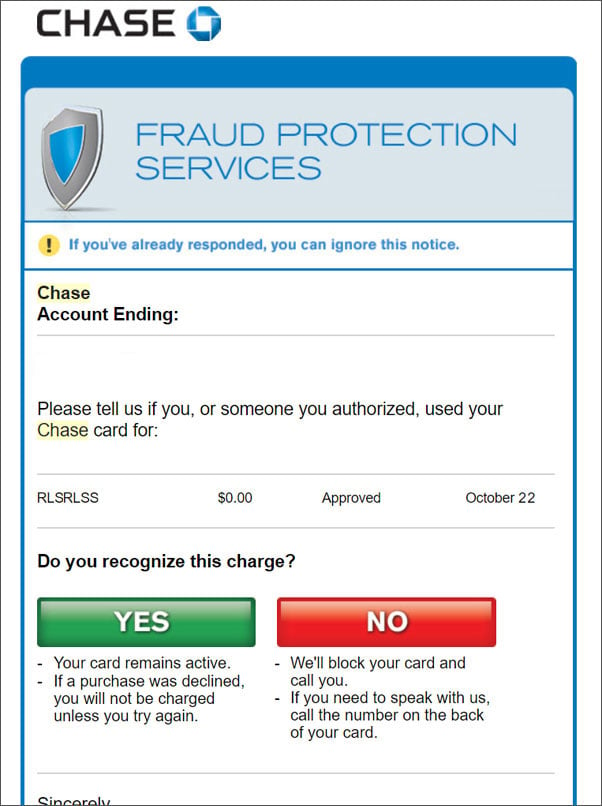

New notes come towards the positives your usually score with a frequent credit card, eg swindle safety if your card is actually shed or stolen. The brand new Indigo Card has the benefit of roadside guidance if you are toward the trail and want some assistance with your vehicles.

This new cards including create very easy to stay on best of your credit rating. Having both reporting towards the about three most significant credit bureaus, you’re sure to note an uptick on your rating, given all the costs were created timely together with balance are paid in complete per month.

There are even a few tips you could potentially pursue for many who need to raise your credit history rapidly

If you need convenience in enabling your own bad credit financing, then pick Borrowing Mortgage, MoneyMutual, or CashUSA. They will match your obtain personal loan rates to lenders in their vast channels.

Keep in mind such three enterprises dont provide finance yourself, but they are effective in bringing your associated with one to, one or two, otherwise three loan providers who have loads of feel coping with poor credit customers. The assistance try 100 % free, whenever its a cards acceptance, you’ll encounter their money in only you to working day.

You might thought refinancing your vehicle or where you can find get some cash quickly. You could turn brand new security on the dollars, and also you may get most readily useful terminology this means that. Automobile Borrowing from the bank Share is the best for this, as it’s expert at providing subprime customers to track down a distributor that is prepared to give you a refi financing, despite your lowest credit history.

If you’re wanting refinancing your house and tend to be eligible to have a keen FHA financing, take a look at the FHA rates book. He has got loan providers who’re flexible so you can consumers such as for instance oneself. Simultaneously, energetic army and you may veterans will get certain decent bucks-away refi money utilizing the Va Sponsored Financial Program.

Once the vehicles and home refinance fund was shielded using the possessions involved just like the collateral, he is added to short term loans Dove Valley CO high unsecured loan costs to less than perfect credit users.

Q4. Do you Improve your Credit history getting a consumer loan when you look at the thirty day period?

There are many activities to do to bring right up your credit score more a half dozen-week to at least one year months. You really need to slow down the amount of current debt you borrowed from, make most of the monthly obligations on the planned payment dates (otherwise in advance of), and don’t personal down the old membership.

First, gain access to all of the about three of one’s credit file using Equifax, TransUnion, and you may Experian. If you discover one mistakes, make sure you query the new respective credit agency to obtain rid ones.

But, how can you look at your credit reports? Well, there are five areas to examine. The first is Public records, where you could guarantee any social number investigation which had been gathered from the county and you may state courts along with range companies. The second reason is concerns, where you are able to look for that has requested to access your credit report and ensure you had been the person who initiated it. The 3rd try borrowing from the bank levels.