Of several internet sites, for example Kelley Bluish Guide (KBB), bring free assessment units that inform you what you can expect to access sale otherwise change-when you look at the. A familiar error, although not, is always to overstate the latest vehicle’s status when the time comes to get into the individuals thinking towards the equipment — both due to an emotional connection to the automobile you to simply applies to both you and never to brand new broker. Centered on KBB, very autos, 54%, are located in “good” updates, one-up from the base class, which is “fair.” Fewer than 1 in 4 are listed because “decent” and only step 3% was listed due to the fact cashadvanceamerica.net student loan rates “advanced level.”

Do not Negotiate Based on MSRP

According to CNN, salespeople is actually trained to negotiate off based on the automobile’s MSRP, which is what they’d need to get on the auto. As an alternative, negotiate right up based on the car’s charge rates, that is precisely what the specialist paid for the automobile. Fundamentally, 2% above the charge price is a reasonable contract both for activities.

Don’t Discuss Considering Monthly premiums

Various other preferred tactic is actually for a supplier to inquire of exactly how much we would like to invest 30 days. Never end up in which pitfall. Immediately following a provider knows your budget, they are able to sell your any sort of car they need. Because of the stretching out the mortgage words, they may be able shoehorn an even more costly vehicles into your monthly funds. The issue is, you earn caught not just that have a far more pricey automobile, nevertheless wind up expenses a lot more profit attention repayments — when they doing the financing, it profit twice. Centered on AutoTrader, $400 1 month to have sixty months (5 years) is enough to possess an excellent $twenty-four,100 car. To possess 72 months (six ages), it is $twenty eight,800, and also for 84 days (7 age), you should buy good $33,600 car for the same $eight hundred payment. Determine what you can afford predicated on a sixty-day percentage package to make that your budget.

Even if it’s rarer now compared to years earlier, centered on CNN, specific dealers however turn to projects designed to keep potential customers about showroom until a great deal is accomplished. Included in this is to request your own license and/otherwise techniques as cover through the a drive. If you go back and determine not to buy, but not, you will probably find that your particular security is within good manager’s workplace, for the a secure place or in other places one to keeps you from inside the the newest showroom since specialist produces a final mountain. Thanks to the go up out of online studies, not, this type of plans has actually mainly been weeded away.

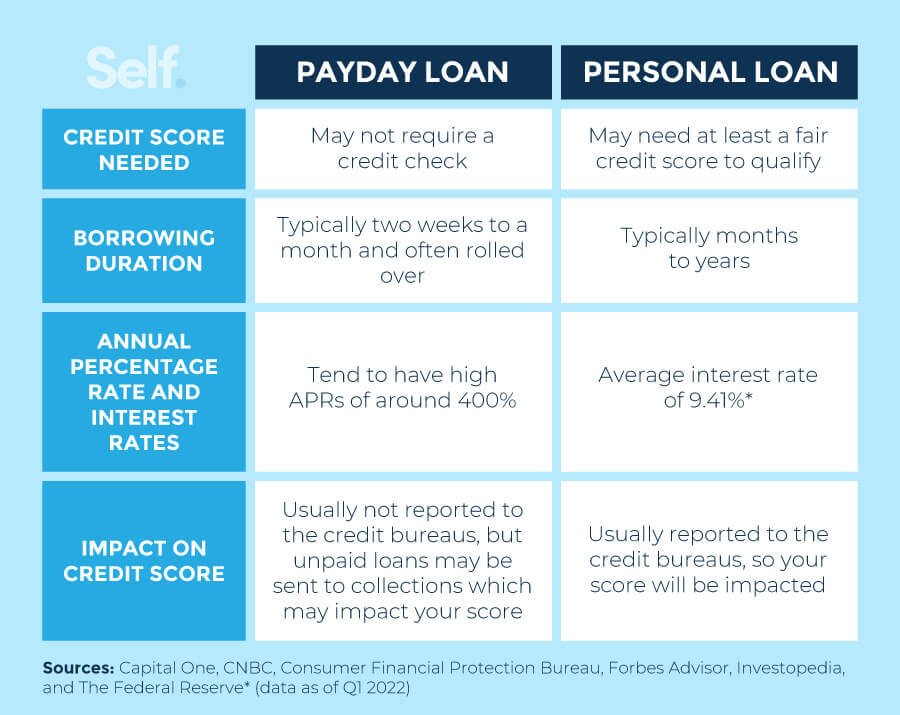

Never ever Invest in an early on Credit assessment

If you intend with the financing an automible, you’ll be able to eventually must submit to a credit check. Based on Auto and you may Rider, however, certain buyers will attempt to make you accept an excellent credit check early in the procedure, maybe while they need “screen” potential customers. Not just does this perhaps not help you by any means, however, very-called hard draws may actually ruin your borrowing from the bank.

Say Zero in order to Charge

Particular fees, such as those of the interest charges, taxation, name and you will membership, are necessary and can’t end up being swept out. Based on User Account, however, of numerous buyers make an effort to sneak additional charge towards the latest bill — and you’ll event all of them. Agent creating, auto procurement and you will automobile creating fees, such as for example, are built-into the desired destination fees. Including dispute advertisements charges, financing commission charges, market changes charges and you will documentation charges.

One good way to stop charges altogether, considering Borrowing from the bank Karma, will be to discuss just the final price, sometimes known as aside-the-door rate otherwise drive-aside price. Give the brand new dealer right from the start that you will be only ready to discuss the very last price, and that all of the fees and you may fees need to be integrated.