After the success of all of our 2011 post Feel Home loan Totally free In the course of time , we now have chose to modify and you can incorporate even more info secured to get a more impressive dint in your home mortgage quicker. All of our Greatest a dozen Strategies for repaying your residence loan sooner’ article has some high offers tips & information you to definitely you can now pursue.

step 1. Pay it back quickly

This new longer you take to repay your residence, the greater amount of you are going to pay. There are various ways to lower your financing, but most of them get smaller to a single matter: Spend the loan away from as fast as yo are able.

Like, should your loan amount is $3 hundred,000 during the 5.46% % for twenty five years, the month-to-month repayment might personal loans no credit check no bank account be about $step one,835. This equates to a whole repayment of around $550,five hundred across the twenty-five season name of the mortgage therefore the complete appeal paid back could be around $250,one hundred thousand (nearly doing your own first amount borrowed).

For those who afford the financing over to 10 years rather than 25, your payment per month would be $step 3,250 thirty days (ouch!) However the overall amount you will pay off along the label off the loan would be merely $390,100 saving you an astonishing $160,five hundred.

dos. Shell out with greater regularity

Many people are conscious that for those who shell out your residence financing fortnightly rather than month-to-month you may make a big effect on paying down your loan. Simply divide your own monthly payment in two and shell out fortnightly rather than month-to-month. It generates several thousand dollars difference between your full repayments and you can slashed years out of the loan. Many people don’t also notice the change.

Why that it works is because discover twenty six fortnights inside the a-year and just one year. And work out costs for the an effective fortnightly foundation means you happen to be making thirteen monthly premiums each year. You will be surprised at the real difference it creates.

step 3. Make money within a high interest rate amount

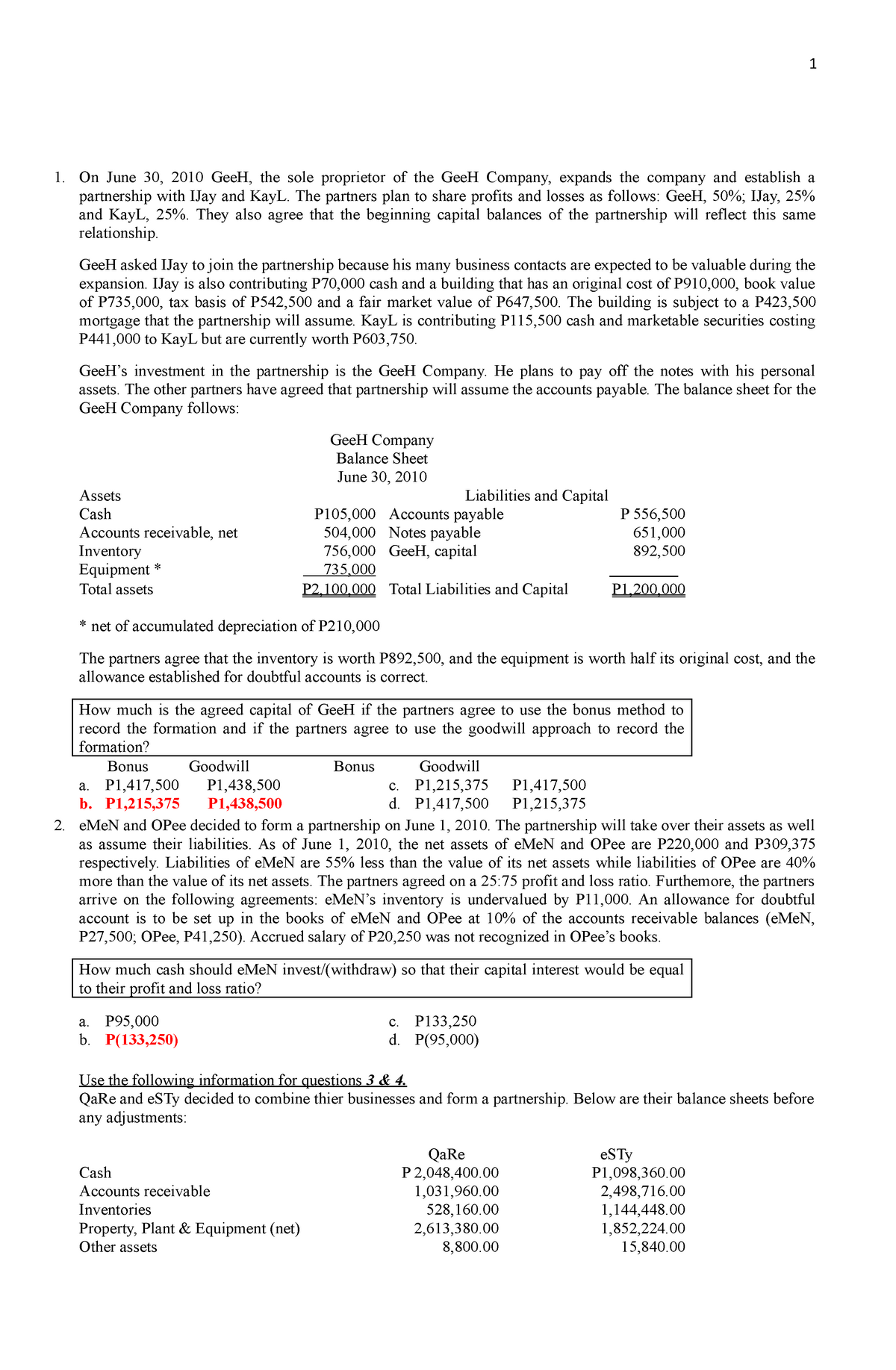

![]()

Lenders will always determine your serviceability during the several basis situations greater than they give you to definitely manage on their own to possess when attention prices improve. This means they feel you can afford to pay significantly more (constantly dos%) compared to the home loan they give you. Consider shell out more immediately?

When your attract on your own loan is around 5.5%, upcoming start using they at the 7.5%. Whenever rates of interest rise (and they’re going to) you simply will not also notice. This also means that you happen to be paying down the loan faster and you can rescuing a bucket within the appeal repayments.

having paying down your house financing sooner or later…*Call us if you prefer us to calculate your own payment shape from the dos% high and to observe how ages we are able to cut-off your loan.

4. Combine your financial situation

You will be spending ranging from fifteen-25% attention on most of your personal debt (signature loans, credit cards, store cards etc). Of several loan providers can help you combine (refinance) all of your obligations to your mortgage. Because of this as opposed to purchasing the individuals highest interest levels, you can transfer this type of debts to your residence financing and you will pay merely 5-6% notice.

The trick and you may most significant advantageous asset of combination is to continue expenses the standard costs you’d ahead of the refinance. And you can cut-up men and women credit cards! This can pay the debt and you can mortgage of far ultimately and you may save you a huge number of bucks inside attract money.

An additional benefit out of combination happens when rates go up. Should your home loan interest rate starts to rise, you might positively guarantee that your mortgage and credit card pricing might increase. Because of the merging your debt, this will shield you from large personal interest rates and you can expensive loans.