Nearly 50 % of Participants State They won’t Understand how Escrow Profile Really works and you will Might possibly be Unable to Shell out in the event that Its Month-to-month Mortgage Commission Increased from the 25% Due to Rising Taxes and you can Insurance

All consumers having good federally backed FHA mortgage must have a keen escrow account for the life span of your loan, regardless of how much guarantee they have

POMONA, Calif., – A different sort of survey of LERETA, a prominent federal merchant from a residential property income tax and you may ton characteristics to own mortgage servicers, means that certainly one of survey participants with an enthusiastic escrow account which have the financial, no more than 1 / 2 ones grasp just how the escrow account works. This will be annoying just like the financial escrow membership across the U.S. will in all probability experience a-sharp raise because of rising assets fees and you can enhanced insurance policies.

Of a lot is economically confronted, and several home owners will demand help to make these types of money and you may continue their homes

Conducted into the February, this new survey asked more 1,000 homeowners who’d purchased or refinanced homes before few years, and you can with a keen escrow account, how good it knew their escrow accounts and exactly how prospective increases do apply to all of them.

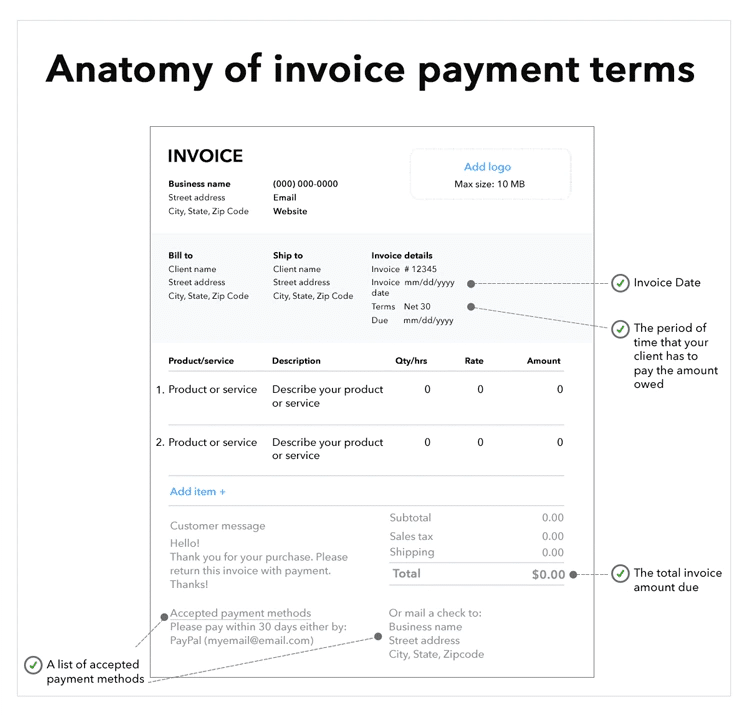

Home loan escrow profile are acclimatized to shell out homeowners’ assets taxes and you may associated insurance fees (residents, flood and you may home loan insurance policies.) Loan providers wanted them getting conventional home loan borrowers with 20% or faster collateral in their home. Nationally, as much as 80% out-of mortgage proprietors possess an escrow membership.

- A majority of the homeowners surveyed more 80% told you they know what an escrow profile try and you will exactly what it is supposed to carry out: which is shell out taxes and insurance coverage. This makes experience because 57% said they had educated a rise in the real estate fees, and you may 38% stated they’d experienced an increase in their residence insurance policies.

- However, simply 52% ones interviewed told you it grasp just how its escrow account really works.

- More than one fourth (28%) are only some aware or otherwise not alert after all one transform in their escrow accounts make a difference its monthly premiums.

- More than a 3rd (36%) who have a fixed-rates home loan trust its monthly payment absolutely do not transform, while it is also.

- Of those that have currently experienced a rise in its monthly mortgage repayment, over fifty percent (53%) was in fact surprised and you may failed to assume they.

Community observers anticipate property fees nationwide to boost due to help you listing home rates adore over the last 10 years. The common domestic rate regarding You.S. climbed 29% due to the fact COVID-19 pandemic began when you look at the 2020, which suggests the likelihood of double-digit income tax expands for the majority homeowners. At the same time, homeowners’ insurance fees was broadening-federal average home insurance will set you back had been upwards 21% by . But not, when you look at the Florida, property insurance fees have increased by the 68% previously 2 years and you can equivalent high increases had been stated inside California, Colorado and many elements of the fresh new Eastern Coast. Certain high insurance rates companies need drawn of certain claims entirely. The lack of battle on these portion is anticipated to increase the expense of coverage.

For the light of them fashion, this new survey located a concerning insufficient financial ability with the https://paydayloanflorida.net/indian-lake-estates/ section of residents to cope with escrow expands. Specifically:

- 1 / 2 of the home owners surveyed (50%) said it would be a trouble when the its monthly mortgage payment increased because of the 10%. Nearly 15% said they might struggle to shell out their mortgage if the their commission enhanced from the one to number.

- In the event that their payments improved by the twenty five%, nearly half (49%) told you they would be unable to shell out their mortgage and you can a unique 30% told you it can introduce a difficulty.

The newest findings bolster what our associates are reading each and every day on our very own tax service phone call stores. From inside the 2023, 60% of one’s calls have been connected with escrow account, especially shortages on account of rising assets taxes or insurance premiums, said John Walsh, Ceo away from LERETA. With observers anticipating an enthusiastic escrow cliff’ from the future years, that it not enough facts are about the. It signifies that people-one another having and you will versus escrow membership-often no less than become benefiting from unpleasant unexpected situations. The mission is to try to assist home loan enterprises raise interaction and you can instructional outreach to people regarding the escrow profile to assist address this growing situation.