Limitation credit limits to own advances are different by FHLBank, but commonly slide ranging from 20% and sixty% away from total possessions. Representative enhances costs fixed otherwise floating pricing across the a great set of maturities, from quickly so you can thirty years. According to latest FHLBank Workplace out-of Funds investor speech, floating-speed enhances are only more 30% out-of complete advances as of . The fresh new maturity from advances has actually shortened along with this specific development towards a drifting rates: More than ninety% out of advances fell inside the faster-than-that four-season assortment towards the end off 2023, a twenty five% raise more 2021. Whenever you are costs are often times up-to-date and you will disagree across banking institutions, Contour step 1 directories a sample out of pricing since .

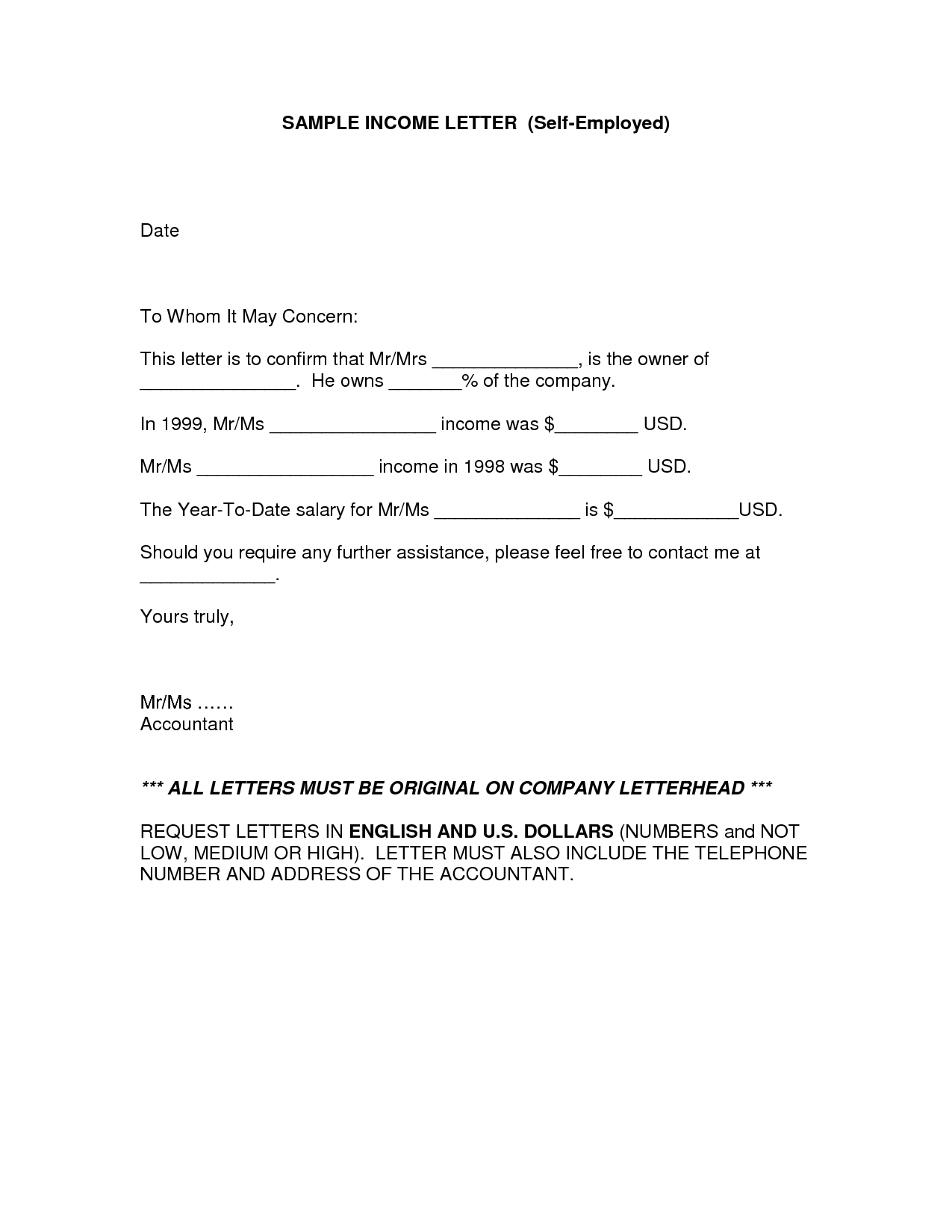

Figure step 1

To help you cash in enhances, individuals have to buy passion-founded FHLB stock and the stockholdings you’ll need for membership. The fresh new FHLBank Workplace off Money alludes to a regular price of cuatro% 5% out of dominating borrowed. Both registration and you can activity-created inventory models bring dividends. So it financing is normally returned to the newest affiliate via stock buyback since the get better was paid down. Advances are also required to end up being fully collateralized by the securities or loans; specific conditions to possess for example guarantee differ because of the regional FHLBank plus the potential borrower’s credit score status. Generally, eligible collateral should be solitary-A ranked or above and you will houses-related. This might become: United states Treasuries, company obligations, department and you can non-institution MBS, industrial MBS, civil ties (that have facts these particular is actually houses-related), bucks, places in the an FHLBank, or other genuine-estate-relevant property. Most, if not all, insurance providers generally currently own most of these qualified equity items. Business securities, personal obligations, and you may equities are not accepted because equity. Brand new haircuts placed on equity will vary by the financial and also by representative-candidate (Figure dos).

Contour 2

FHLBanks have the ability to provide very competitive rates as compared to industrial lenders, and you may detection of this registration work for keeps growing certainly one of insurance providers. Year-over-seasons growth of insurer registration on the FHLB program has been continuously confident for the past 25 years. All in all, 68 the insurers registered this new FHLB from inside the 2015, a historic high. Ever since then, new FHLB program provides benefited away from typically twenty six new insurance-team people a-year.

These people is taking advantage of attractive credit words: Advances so you’re able to insurance policies-business users hit a the majority of-big date a loans Belleair lot of near to You$150 billion in the 1st one-fourth away from 2024. In a study in our insurance rates customers on their FHLB enhances,8 participants quoted a wide range of purposes for the amount of money, also unexploited crisis exchangeability, energetic liquidity spread enhancement investing, asset and you will liability management (ALM) demands, acquisition funding, and you will refinancing regarding 144a debt.

Even more broadly, registration by insurance agencies expanded at a yearly speed away from 7% in the period from 2013 from the very first one-fourth of 2024. New % of overall face value regarding insurance company enhances flower 8% annually across the exact same period, considering investigation regarding the FHLB Work environment of Finance profile. Since the first one-fourth regarding 2024, insurance providers got borrowed 19% regarding full an excellent FHLB advances, or You$147 mil. Enhances had been prolonged so you’re able to 235 line of representative individuals out of 580 full FHLB insurance coverage people (find Shape 3). One of the core benefits due to the fact a keen FHLB debtor are availableness to exchangeability in a situation of market fret. The new evident drop when you look at the % express out of total face value from enhances drawn because of the insurance agencies reflects a 30% rise in borrowing by industrial financial institutions season more year and in tandem to your be concerned believed regarding the financial industry on the springtime out of 2023 (pick Figure step three). Brand new shift into the borrowing from the bank volume depicts the way the FHLB program helps just its members’ providers demands, also that from the larger money areas.