Of a lot potential real estate buyers begin its a property journey thrilled and some unacquainted with whatever they have to do to boost the probability of allowed and avoid financial mistakes.

Carrying out your way to find property was daunting, but you’ll get the processes easier and less confusing if the you manage advantages concerned with the best attract.

fifteen Popular Mortgage Software Mistakes to prevent

- House Hunting In advance of Loans is eligible: Of a lot household candidates are very happy within potential for shopping for its fantasy home that they adore property just before they understand if they score financing acceptance. So it set you up to possess frustration as the even although you are highly going to have the mortgage, the time must agree this means a special client can simply seal its offer earliest.

- Less than perfect credit: One of the first anything loan providers do are glance at applicants’ credit history. Even though you gets investment having average credit, individuals with good credit are instantly favoured over people who have bad or bad credit. The reason being lenders look at the credit history (early in the day actions) to indicate your likelihood of repaying the loan (upcoming actions).

- Too many Programs: Of many apps to have money loans Grand Bay AL otherwise borrowing from the bank mirror improperly on the creditworthiness. Loan providers select trying to get of a lot fund during the a short span once the reckless conduct, indicating a dismal credit exposure.

- Maybe not Deciding if you Qualify for the original Family Owners’ Grant: While you are to invest in otherwise strengthening a separate household which is also very first home, you’ll be able to qualify for the initial Household Owner’s Offer. That is an excellent $ten,000 payment to greatly help very first-go out consumers inside to order a new home otherwise building their earliest family.

- Underestimating Simply how much To acquire property Will cost you: Buyers do not always look at the many can cost you from home buying. Things like Stamp Obligation, Lender’s Financial Insurance, examination fees, app fees, and many other things expenditures can come up one to create a great price towards real cost of our home.

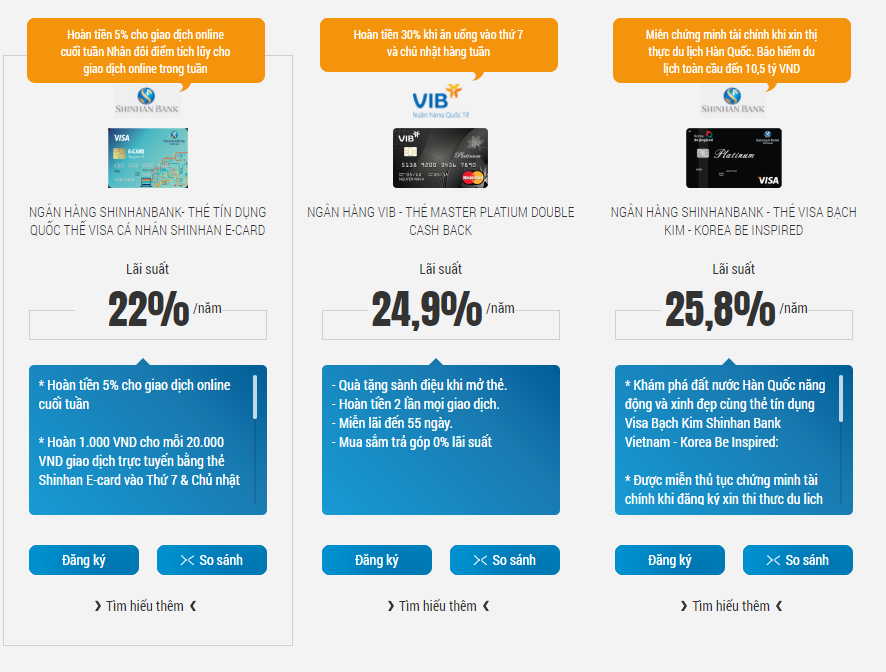

- Maybe not Looking into Every Capital Solutions: Of several consumers make the mistake regarding merely considering precisely what the large banks have to offer. There are various excellent individual lending provide and you will reduced shop financial organizations to purchase advanced level cost and practical terms. Envision speaking with a financial professional who will identify the options.

- Trying out Significantly more Loans Than simply You can afford: Just because youre accepted having an especially high loan does not indicate this is your best choice. Consider all of the numbers before deciding to take on that loan, specifically if you getting embarrassing into the number.

- Missing Loan Payments: For those who regularly skip costs in your financing, your have shown a terrible ability to service home financing.

- Trying to get a home loan Centered on Only the Interest: Many lending organizations grab notice by the adverts lowest-rates. They truly are basic pricing with most certain standards attached. Here are some numerous rates and their requirements as advertised rates might not be the best readily available.

Just how can Banking companies Evaluate Financial Applications?

When you establish your loan application to own acceptance, you’ll want an organised, complete, and you will specific document. Of numerous borrowers ask practical question, How can banks assess financial applications? Financial institutions or any other large lending institutions examine several conditions while in the the fresh new approval processes. For example:

Can it be More challenging discover a home loan Today in australia?

You are right if you were to think that getting home financing app acknowledged takes expanded and that’s more difficult than in recent ages. Loan providers are concerned on expensive home loan mistakes therefore the demands against borrowers. You will find some good reason why, including:

This is exactly why its useful to has actually a mortgage broker on your side to chase within the banking companies for you and make sure that your software becomes across the line in the a fast trends.

Just how can Quantum Financing Australia Let?

Youre more than lots so you’re able to all of us in the Quantum Loans Australia. The house loan application gurus take care to arrive at learn you and what you need to help make your goals out-of homeownership possible. We’ll guide you from the software process, remove the dilemma and you can fret, and appear by way of a huge selection of chances to find the correct financing selection for your.

For more information or perhaps to consult with a experienced associates, contact a large financial company now. I have helped numerous homebuyers find the investment needed, and in addition we can help you as well.