- Your own full home address, including the area, state, and you will area code

- The state where in fact the house is receive

- The kind of possessions

- What you are currently with the possessions to have (first house, trips home, or rental)

- The first and you may history term

- Their email address

- Your contact number

- Information about how you might play with an effective Hometap capital

- Your dream period of time for choosing the cash

You will get an immediate investment guess in the event the Hometap have sufficient information to include you to definitely. You will be connected with a dedicated Hometap Capital Manager which will work along with you regarding whole process.

All of the time, the process can take as little as three days throughout the application time until you located the wired funds.

In the event the Hometap isn’t the best method for both you and your personal fund state, you really have additional options for finding the money you desire away of your home’s really worth.

Domestic guarantee financing

You could imagine a property collateral financing, enabling payday loan Canaan one borrow on your residence for the a traditional means. This is exactly financing secured by property value your home, that provides you with a lump sum payment in one go. You pay back that it mortgage over time, plus the lender charge attention.

Domestic equity credit line (HELOC)

You can also speak about household equity credit lines (HELOCS). Rather than an apartment lump sum, you are provided a maximum draw amount and pull out around called for, as much as one to overall.

You could potentially mark about personal line of credit as needed throughout the the latest draw months, hence usually continues doing 10 years. HELOCs are helpful as the a beneficial revolving personal line of credit, especially if you’re performing household renovations built to boost property opinions. The resource need may fluctuate from the endeavor – you can simply borrow a small percentage of one’s restriction draw count, following pay it off prior to brand new mark several months is over.

You’re going to have to spend appeal on which you borrow within the draw months, however, otherwise, you may be able to draw up towards the restrict as often due to the fact you wish (provided you pay it back prior to withdrawing even more).

2nd it is possible to initiate the new repayment period, during which you will need to make typical monthly payments right back founded on everything you borrowed, in addition to attract. To learn more, listed below are some all of our selection of a knowledgeable lenders.

Unlock

When the financing or line of credit doesn’t voice most useful, Open is another company that gives profit replace to have a great portion of your own house’s equity. Such as Hometap, Open is not supplying financing, which means this will not show up on your credit score, and also you repay otherwise accept the fresh resource inside 10 years.

You prefer at least FICO get off 500 so you can be considered, while spend deal expenditures and you may an effective 4.9% origination fee in the closing. The price tag exceeds Hometap’s step 3.5%, and you will Unlock’s maximum domestic equity availableness is $five hundred,000 (compared to the Hometap giving up to $600,000).

FinanceBuzz writers and you will editors get products and organizations toward several regarding objective have together with our very own professional editorial review. Our very own people dont determine all of our critiques.

Predicated on Hometap’s Frequently asked questions, For those who deal with the new funding promote, you are able to romantic in your purchase and you will located wired loans contained in this 4-one week, and you may Hometap costs good step 3.5% percentage for the qualities.

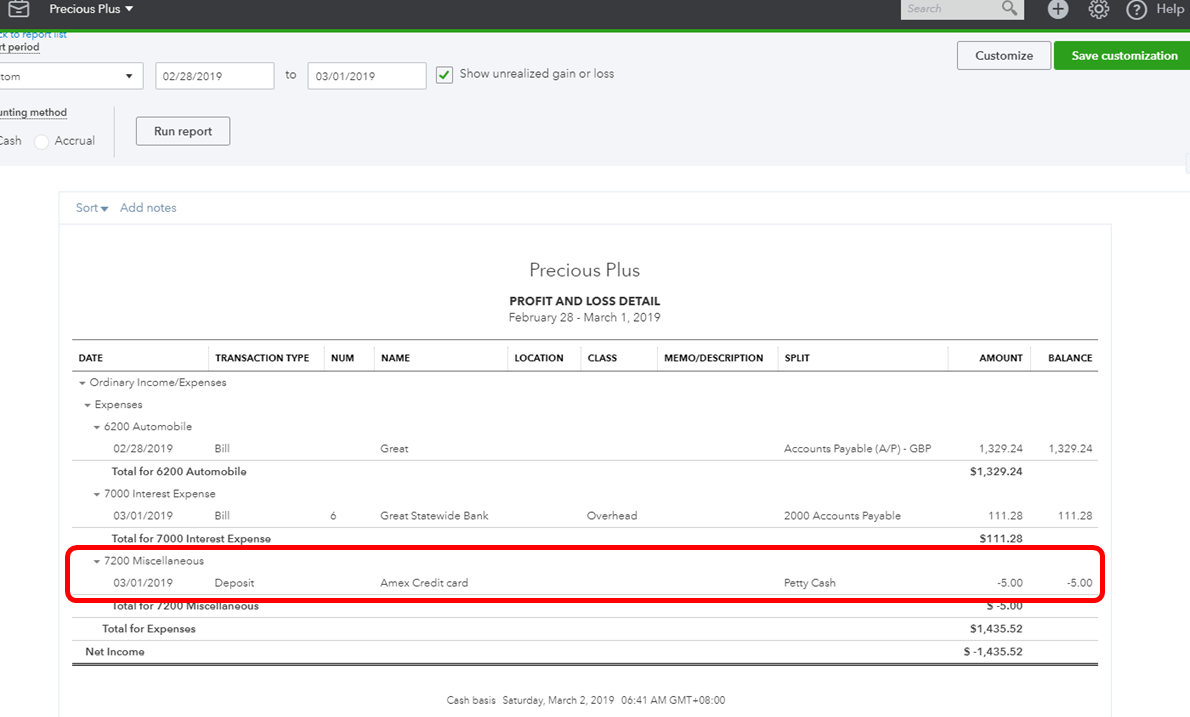

I made use of Hometap’s very first calculator in order to plug inside a home well worth of $eight hundred,000 and you will capital off $forty,000, with differing cost of depreciation otherwise appreciation. We have found what is projected to occur immediately following a decade:

Although you do not have consent to market your house, youre likely to improve Hometap in the event the any kind of time section during the this new ten-seasons title you opt to: