Having SBI financial people, the capability to install your property financing report on the web also offers a smoother treatment for monitor finances. Availableness and you can install business arrive both online and off-line, making certain all the customers is do the financing statements effortlessly. Whether it is examining brand new a good balance or contrasting the improvements off loan cost, the web based program provides a seamless sense.

Playing with individual history such as for instance day of birth, Aadhaar Cards, and you will Pan Card, consumers can safely get on availability the comments. So it digital approach just conserves big date and in addition allows for the use of systems such as the mortgage EMI calculator, improving the handling of private cash. SBI’s dedication to delivering electronic options empowers consumers to keep on the finest of their economic travel.

Understanding the Concepts of your own SBI Mortgage Membership Report

Expertise their SBI home loan membership declaration is vital to have handling your loan efficiently. It provides info like the a good equilibrium, the pace used, and the cost record. To own SBI mortgage customers, opening mortgage statements online and offline is simple, providing an intensive summary of the loan account. Normal review of these types of statements helps in monitoring costs and monetary think, ergo at some point assisting you plan and you can spend less for your home

The significance of Daily Checking Your own SBI Mortgage Statement

Home loans could be extremely beneficial for the newest individuals, not merely do it help in putting the foundation of the fantasy life in your dream room, this new have concrete tax masters provided by the brand new governments.

Being told from the loan details facilitates and then make advised behavior throughout the upcoming monetary thought. Regularly checking their SBI home loan declaration is paramount to handling profit effectively. It permits individuals observe new the equilibrium, making certain that payments take track. Opening financing comments online and traditional will bring independency when you look at the managing economic financial obligation.

Just how Your SBI Mortgage Statement Will help Take control of your Funds

Financing statements are more than simply records of transactions; he could be equipment for monetary government. Of the looking at your loan statements daily, you could tune how you’re progressing within the paying off the borrowed funds. Which routine aids in identifying any discrepancies very early and you may ensures that your financial desires are on tune. Productive handling of your loan statement causes total monetary fitness and you can balance.

Step-by-step: SBI Home loan Declaration Obtain

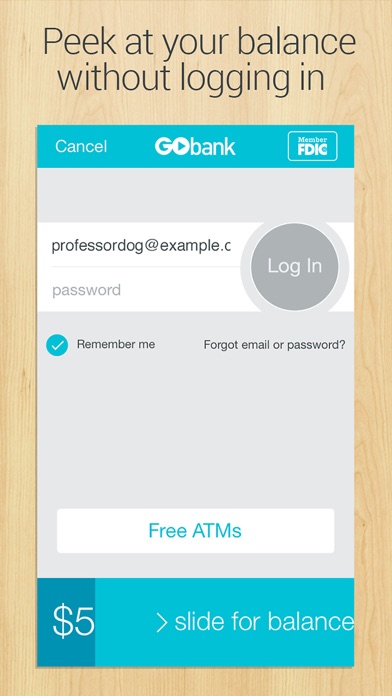

Downloading their SBI financial declaration is a simple techniques. SBI provides an user-friendly on the internet system where people can certainly supply their mortgage comments. So it electronic provider means you can feedback the loan information whenever, adding to finest monetary management.

- Discharge your on line browser and you can accessibility the ‘Personal’ part of the Condition Bank regarding India’s formal webpages.

- Toward individual financial webpage, simply click ‘Login’ and complete your own username and password as the provided by the bank.

- Demand ‘Enquiries’ case and click into the ‘Home Loan Attention Certificate (Provisional)’ link.

- Select the mortgage take into account you require the report.

- Discover your residence loan declaration or notice certification, you may either:

- Find it on the web

- Printing it

- Install it as a good PDF file

- The latest downloaded document was you could try this out password safe having improved shelter. Brand new password basically are history 5 digits of one’s entered cellular number and you will time out of delivery throughout the style regarding DDMMYYYY.

Releasing the new Obtain Techniques for the SBI Home loan Report

To start getting the SBI financial declaration, financing consumers need log in to the internet portal or mobile software the help of its password. That it 1st step means that the process is safe and this just licensed users can access mortgage comments. It’s an effective treatment for would mortgage information and remain updated towards mortgage improvements.