These types of risky mortgage things might have rates of interest all the way to 35%, centered on research by the Scholar Borrower Security Heart.

- Current email address icon

- Twitter icon

- Myspace icon

- Linkedin icon

- Flipboard icon

- Printing icon

- Resize symbol

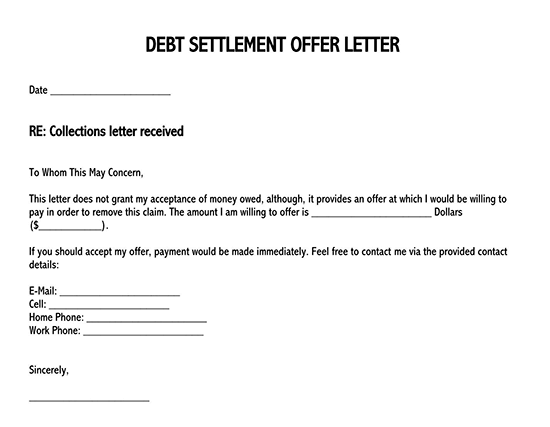

A separate declaration features the newest $5 mil ‘shadow’ pupil personal debt industry. (Photos of the Robyn Beck / AFP)

Approximately 49 mil People in the us is managing $step one.6 trillion in the scholar-loans, but that staggering profile more than likely underestimates your debt borrowers is taking on to finance the degree, a new declaration means.

Over the past a decade, children keeps borrowed over $5 million because of an enthusiastic https://www.paydayloanalabama.com/northport/ opaque net out of companies to cover degree at to have-finances universities, the Student Debtor Safety Cardio, an advocacy class, found. These materials, that aren’t traditional government or individual student loans, will bring highest interest levels or other risks having individuals, with regards to the SBPC.

Additionally, by giving financial support in order to youngsters, so it shadow borrowing system, since the SBPC dubs it, helps to keep programs training children getting jobs when you look at the sphere particularly transportation and you may cosmetology in business – even in the event they have been prohibitively expensive for most plus don’t offer graduates which have a great credential that is worthwhile throughout the work markets.

Which whole cottage industry is permitted to victimize and tear from the really insecure borrowers within nation, told you Seth Frotman, the fresh executive movie director of your Pupil Borrower Shelter Cardiovascular system. These types of professionals are foundational to cogs about larger student-personal debt crisis, plus critical components of just what allows predatory universities to survive.

Brand new shadow borrowing system’ is continuing to grow given that Great Recession

Regardless if normally out from the personal and regulatory eye, these things have taken into a far more well-known part in the beginner money land once the High Market meltdown, depending on the SBPC’s statement. Prior to now, for-earnings colleges relied on conventional, private lenders to add funds to help you people, that happen to be included with her and you can ended up selling to dealers. Usually this type of funds have been made to college students with little respect to have whether or not they would be able to pay back her or him.

On the decades because overall economy, traditional, individual loan providers have much lower their engagement about beginner-financing markets broadly. This type of therefore-titled trace lenders strolled in to fill the fresh new emptiness for students financing job studies during the to have-money universities, with regards to the declaration.

These businesses work at schools for the three secret indicates, the brand new declaration discover. The foremost is since the a private mate for students in need of funding. Oftentimes that can imply development a product to possess a good specific system or enabling a school lend in order to the pupils. The second is by offering a different borrowing merchandise that when you look at the some instances colleges tend to provide due to their website or school funding information.

The next try servicing or event to the personal debt college students are obligated to pay to schools for tuition. In these cases, students have a tendency to subscribe an application without having to pay things at the start, but end up due this currency which have attention. Some of the companies highlighted on the SBPC declaration work at schools to help you service and you will collect it personal debt, they located.

Steve Gunderson, the principle exec officer regarding Profession Studies Universities Universities, a swap category representing to own-money universities, got trouble with the fresh new declaration and you can, particularly, their ten-12 months extent. The guy asserted that from the like the strategies regarding large schools that possess since the turn off, for example Corinthian Colleges and you will ITT Tech Institute, the fresh new report attempts to select sins of the past and rehearse them to define and identify the latest sector now.

A multi-age group, family-had college or university from inside the a residential district is going to do whatever they can to greatly help the students, the guy said. If for example the trusted option is in order to loan money straight to children, they’ll exercise with the better of motives even once they don’t possess everything you and that i phone call an educated away from strategies.

Rates of interest as much as thirty five%

These products showcased of the SBPC are offered by about a dozen type of people and bring several threats to possess individuals, the latest declaration located. In many cases, rates is as high as 35%. In others, they carry costs that are not typical out of federal and personal pupil mortgage activities.

But they’re not only pricey; these things put borrowers on the line in other implies. One lender, TFC Tuition Money, advertises so you’re able to breastfeeding schools finding its financing system one a beneficial borrower’s certification are taken away in case there is standard, this new declaration receive. TFC failed to instantaneously address a request for discuss the fresh statement.

On the other hand, some activities need one borrowers feel denied by various other bank just before being qualified; someone else advertise that they can bring capital in the place of a credit check or underwriting.

Meanwhile with the colleges, products create a method to sidestep regulation, new statement receive. To possess schools you to definitely believe in government financial aid, these items can help her or him adhere to the fresh controls, a guideline that needs universities finding federal educational funding to find no less than ten% of its money from a source besides the brand new government’s pupil financing system. By the handling this type of opaque loan providers, schools can create their unique lending apps you to children may use to finance tuition, and this cannot amount for the this new ninety% limit to your federal educational funding money.

To have apps which are not certified, hence can not be involved in the fresh new government education loan system, these products give a source of financing for students who wouldn’t or even have the ability to afford the apps and a supply of cash towards colleges.

This new report appetite governing bodies in the various account to take a better have a look at these firms, and because of the requiring them to join county government by undertaking a national registry of all of the nonbank monetary features companies, and additionally those emphasized about statement.