But what for people who possess more homeownership? Let’s say you possibly can make inactive money from committing to real house? This new month-to-month lease costs and house guarantee allows you to build suit old-age savings, along with create extreme generational riches for your family with purchased attributes.

Thus usually do not miss out on a bona fide house deal as you run out of investment. Alternatively, check out this type of eight innovative resource options for to purchase funding qualities!

step 1. Cash-out Re-finance

With regards to kind of innovative financial support inside the a property, consider a profit-out re-finance. So it financial support choice enables you to use your residence’s security in order to borrow adequate money to repay your financial and have now leftover money to expend in other places.

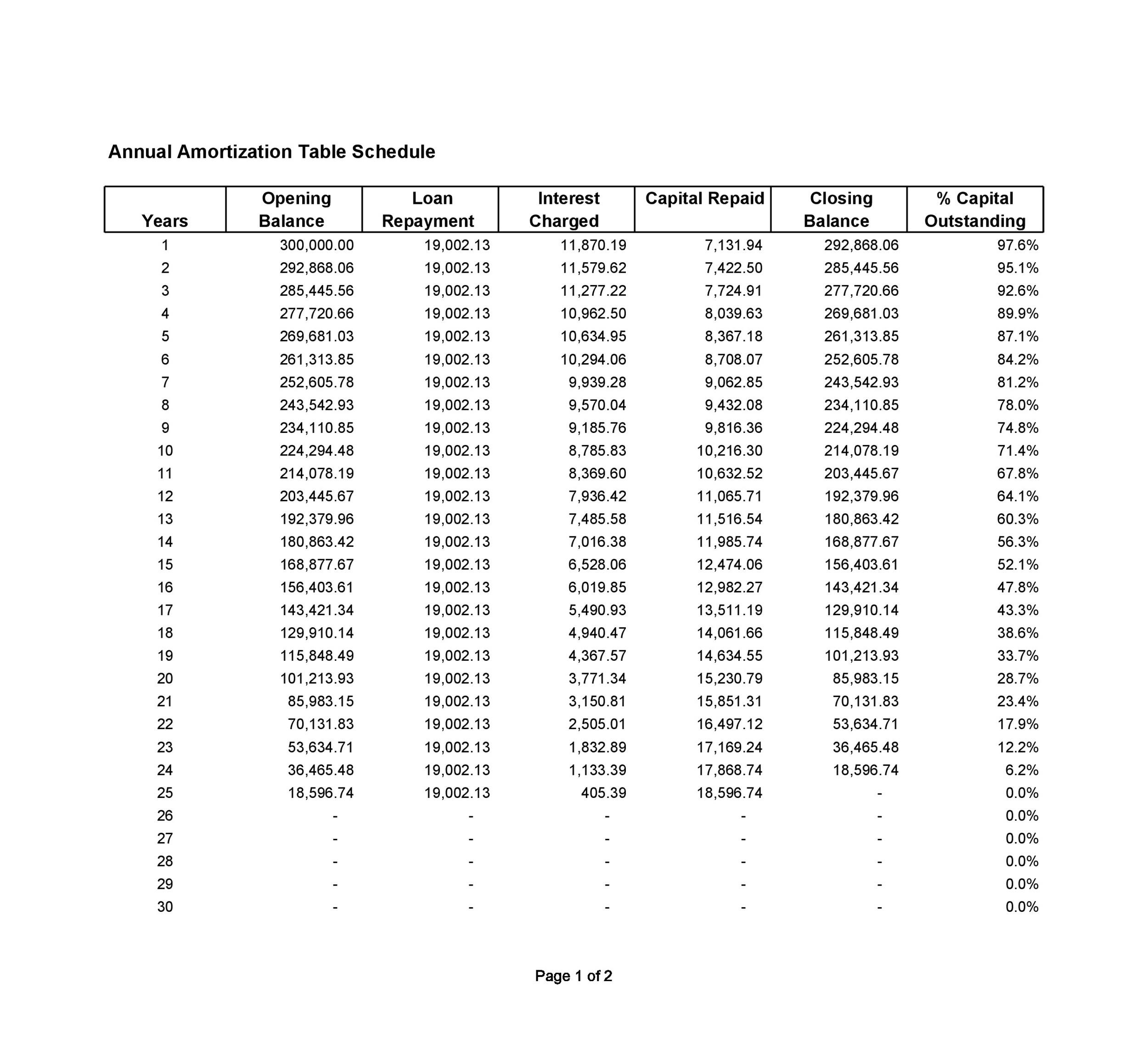

So it innovative capital method is desirable because also offers greatest appeal terms and conditions than just a timeless house guarantee mortgage, and interest paid off is actually tax-deductible. Although not, this option resets your financial term, meaning you ought to continue and also make monthly payments getting 29 alot more many years. Your loan-to-well worth proportion will additionally raise.

A comparable option is by using the guarantee from inside the a preexisting possessions to finance yet another assets owing to get across-collateralization, in which the present possessions acts as most guarantee. Using this type of strategy, you could potentially funds accommodations assets without needing an extra financing.

2. Family Guarantee Personal line of credit

Good HELOC makes you borrow money contrary to the property value your primary house. HELOCs always include a draw months (up to ten years) and you will an installment period of up cash advance payday loans Pine Hill AL to 15 years. The attention is income tax-deduction up to $100,000.

- Make it interest-just money to preserve financing

- Support down payments

- Money home improvements in place of highest rates of interest

- Promote link resource

step 3. FHA Loans

FHA financing are ideal for very first-go out homeowners who don’t be eligible for a traditional mortgage. Despite the fact that appear out of antique loan providers, the fresh new Federal Property Management backs these funds thus those with a good bad credit rating otherwise minimal money for an initial advance payment can always buy a house.

An enthusiastic FHA mortgage and additionally typically has a reduced rate of interest than just a vintage real estate loan, so it’s a nice-looking capital solution.

However, consumers need to nonetheless pay a little deposit (constantly 3.5%) to help you safe an FHA financing. For many who need a zero-money-down option, you will need to thought other types of fund.

4. Hard Money Lending

- Family flipping

- Rehab programs

- Times when quick financial support needs and you can old-fashioned financial support was not available

Tough money lenders make use of the assets as guarantee, resulting in fast acceptance times. Yet not, such finance normally have highest rates of interest and you may origination fees than finance out-of conventional lenders.

Of the increased chance, you really need to only consider a difficult money financing when you yourself have experience with the true house sector and you may an audio get off method.

A separate imaginative funding opportinity for home try a consumer loan from your own IRA otherwise 401k bundle along with your employer under control to truly get your down-payment. You might normally acquire as much as 50k having a downpayment and you can pay it back with appeal on the individual plan without paying income tax on it. Quite often, you can aquire they auto-deducted from the paycheck, and that means you won’t actually miss they.

You will clean out some combined focus, however, an effective owning a home gives you adore over many years, so make sure you have a look at exactly why are the new really sense for the earnings. The interest you have to pay into the loan along with extends back to help you your, very you’ll make up a little bit of the real difference.

6. Leverage Everyone

Planning into the an investment with a buddy having best borrowing or maybe more liquid assets than simply your was an easy way to help you financial on your advantages and you can decrease the weaknesses.

You happen to be an effective negotiator which have super credit but have no cash to shop for one minute possessions. Your buddies otherwise loved ones might possibly financing your money to have a downpayment, as well as in exchange, they’ll very own an element of the possessions and perhaps found a portion of your leasing money.

Of course you don’t have great borrowing from the bank? You can believe seeking to purchase specific home which have anyone who when you are providing the cash with the down payment.

You could also consider crowdfunding to raise certain investment. Crowdfunding spends on the web programs so you’re able to aggregate opportunities out-of multiple someone, enabling individuals with couples finance to sign up a house spending. Well-known crowdfunding internet sites tend to be GoFundMe and you may Kickstarter, but there are also websites certain to help you increasing money the real deal house investment solutions, such EquityMultiple, Fundraise, and RealtyMogul.

7. Most Choice Capital Solutions

- Seller funding (or proprietor investment) is when the property provider provides resource straight to the customer. However, inspired suppliers struggling with its mortgage repayments should not look at this solution.

- Such supplier investment, you can also carry out a lease option (or lease-to-own) towards homeowner, where dealers find the assets after a rental agreement to have a fixed cost.

- Private money lenders tailor funds in order to satisfy borrowers’ means, one thing antique banking institutions are unable to do mainly because lenders are often coworkers, household members, household members, otherwise neighbors.

Explore Creative Investment in A property Having Couples Mortgage

Whenever exploring creative financial support the real deal estate, your best option to you depends on your financial situation and resource wants. Yet, with lots of a home financial support possibilities, there is something right for your position.

Ready to secure capital for your owning a home? Incorporate now for the loan types of their choosing on Associates Home loan away from Florida, Inc. You can expect several mortgage and you may refinancing options for residents and you can people the same, together with jumbo fund, old-fashioned finance, and you may USDA funds.

Unclear just what loan types of is right for you top? Get in touch with we, and we will make it easier to mention the choices.