This is exactly really mans reaction to settlement costs. Although not, you’re not only are nickel and dimed. On this page, we are going to talk about:

- What you’re actually purchasing once you spend closing costs

- Exactly how much mediocre closing costs have Utah

- The best way to to evolve your own loan’s terminology getting all the way down closing costs

- Tips and tricks that may probably reduce your settlement costs

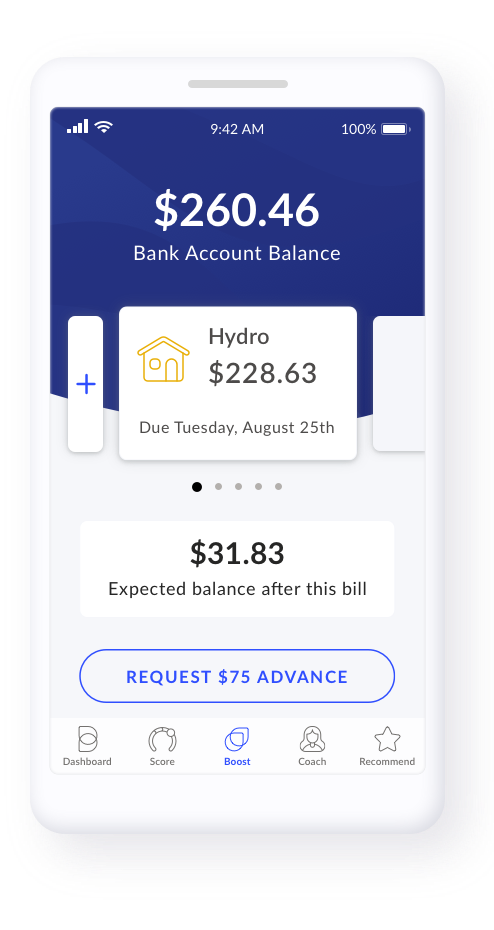

Too often, inquiring to truly get your settlement costs ahead from your financial is like take pearly whites. Not during the Town Creek Home loan. The objective was openness and you can transparency, so we conveniently bring closing costs rates if you are using our price finder and you will closure rates estimate device. It will require lower than dos times. While some of these amounts try at the mercy of transform just before closing, i centered it device become given that clear, thorough so when particular that you can.

Locate an offer including the that you can see regarding the image above, simply play with our price and you will closure cost calculator unit from the in search of an alternative lower than.

What is actually Inside For me personally? Why Also Purchasing Closing costs?

An average home buyer will not understand why they have been purchasing closing costs, they simply see they have to to get its new home.

Closing costs coverage different very important attributes and charge you to helps a safe, legally agreeable, and you will productive home purchase procedure.

Purchasing settlement costs means the house is truthfully respected, this new label is clear of every liens otherwise encumbrances, additionally the transaction is actually properly noted and registered with the compatible government.

In the place of these types of services, the acquisition of a house might possibly be filled up with uncertainty, legal dangers, and you will probably devastating financial losses both for buyers and suppliers. Basically, closing costs provide coverage for you since the a house visitors or seller by the shielding your upcoming otherwise newest resource, and you can making certain this new simple import out-of property possession.

What to expect: What exactly are Closing costs for the Utah?

Depending on the most recent federal research , for the 2021 the typical settlement costs within the Utah is actually $4,837 which have the average family price of $488,644. It is everything 1% of the cost Bakersfield CA payday loans regarding a house. Utah’s settlement costs was lower than the latest national average.

The latest national average to have closing costs are $six,905, which includes household import fees. Yet not, Utah is the most a fraction of says that do not enjoys import taxation when completing house purchases, thus Utah’s profile doesn’t come with fees. In place of import taxation, the new federal mediocre to own closing costs during the 2021 try $3,860.

In a nutshell, Exactly what Actually Try Settlement costs?

Closing costs is charges you to definitely consumers and you may providers need to pay to help you done a home purchase. Each other homebuyers and you will vendors pay particular closing costs, and they expenditures were fees energized of the third parties additionally the financial.

Around the world, homeowners is anticipate paying from 2% so you can 5% of your own price of their house to summarize costs. Thus possible consumers is to prepare yourself because of the putting aside currency in their mind in addition to their off money.

With regards to the Zillow Home values Index , an average worthy of or cost of just one-house when you look at the Utah at the time of 2023 was $495,920, and you will residential property in some counties of the condition enjoys highest average costs. Whenever you are searching for property, this means that you might anticipate paying approximately $nine,900 so you can $24,790 in closing will cost you if you purchase a home from the a beneficial cost equalling an average household really worth throughout the county.

Thankfully, not, you can negotiate the burden to have investing settlement costs on the provider, and you will settlement costs tend to be below the newest national mediocre set of dos% to help you 5% to have buyers for the Utah.