This short article try subjected to a comprehensive facts-examining processes. Our professional reality-checkers be certain that blog post advice facing no. 1 sources, legitimate publishers, and you can specialists in the field.

We located settlement throughout the products and services stated within tale, nevertheless the opinions will be author’s ownpensation will get feeling where offers appear. I have not integrated most of the readily available products or also offers. Find out about how we make money and you may our very own article principles.

While learning how to help save for advancing years, you’ll be able to periodically have a primary requirement for bucks you have put away. Particularly, you might inquire as much as possible withdraw money from the fresh new membership harmony on your own private later years account (IRA).

If you’re IRAs don’t let you to pull out the sites loans the way some 401(k) and 403(b) old age preparations carry out, possible accessibility the cash in your IRAs.

One option is to simply withdraw the bucks and use it. Yet not, brand new Internal revenue service necessitates that your put the money your debt on the an identical otherwise an alternate IRA contained in this two months (labeled as an excellent 60-date rollover several months). If you don’t, you’re going to have to spend taxes and you may penalties towards withdrawal.

At the same time, you might merely make this kind of withdrawal penalty- and you can income tax-free shortly after inside the a good 12-month several months regardless of what many IRA levels you really have.

Because of the significant caveats out of borrowing money that way, it must be utilized meticulously. not, there are many conditions where it may seem sensible while the a kind of short-identity financing. We’re going to mention among those items right here.

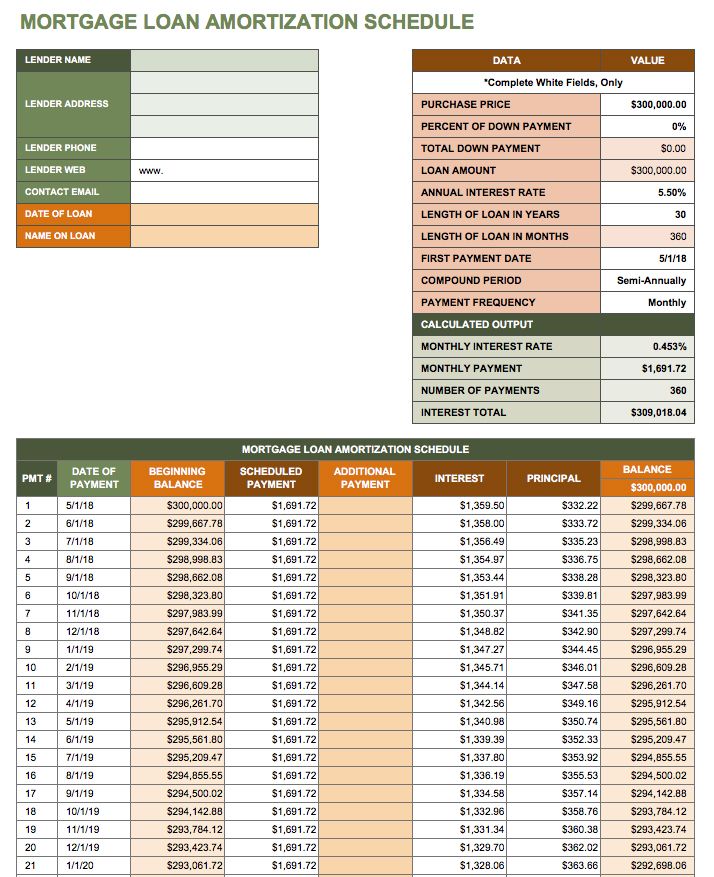

When you need to purchase a property, you may have to build a deposit so you’re able to qualify for a home loan. You may not must place the old-fashioned 20% off, you may have to set at the least step 3% down.

When you’re step 3% may well not appear to be far, 3% towards the a $three hundred,000 home is $9,000. Also you to amount can be a barrier for the majority consumers.

Paying down high-appeal financial obligation

High-attention financial obligation can be a primary economic burden. Payday loans and some unsecured loans incorporate interest levels one to can also be trap people in never ever-finish obligations time periods. Many credit cards will do an identical.

Of course, you can lower bank card stability with some of your finest harmony import cards, but they could well be out of reach without having about good credit.

To avoid financial difficulties

Possibly you’ve gotten a final see away from a collections service, or you are days at the rear of for the mortgage payments. These products occurs, sometimes, by way of no-fault of your own. When you can address the challenge lead-towards the, you’re capable resolve the problem before it becomes bad.

Even in the event an enthusiastic IRA detachment is risky, it might be worthwhile if it helps you prevent losing your home.

Handling medical need

With regards to the Kaiser Friends Foundation, more than 9% out of grownups owe more $250 because of health care costs. What’s more, more than half those individuals owe more than $2,000, and several actually owe more $10,000.

If or not you have got a different sort of ailment one to pops up or if you curently have scientific personal debt, an enthusiastic IRA withdrawal make experience in this case. Its never ever best that you prevent otherwise impede cures while the you will be worried regarding the will set you back.

Taking immediate domestic or car solutions

Should your vehicle otherwise home requires repairs, you truly are unable to overlook it because it’s very costly. Speaking of very first features we cannot mode in the place of.

Like, a leaking roof can cause water damage and mold, hence just increases the price of fixing the situation. In case your vehicles doesn’t focus on, you happen to be unable to travel to focus, ultimately causing shed wages. Again, the difficulty merely gets worse.