Sr. Homelending Director/Vice-president of Transformation, Flagstar Lender, CDLP

Finding out how far you really can afford is amongst the first stages in the house-to purchase process. Many potential homebuyers worry about impacting their credit score that have good tough borrowing from the bank pull. Luckily, there’s an easy way to estimate the mortgage degree without it. Here is how to locate a professional estimate having fun with globe guidelines.

Measures to getting Pre-approved to possess a home loan

Whenever investigating your own financial solutions, it is necessary to estimate how much cash you might acquire created into factors such as your earnings, credit rating, and you can latest expense. Loan providers generally realize certain procedures whenever deciding whenever you are eligible for home financing and you can calculate a financial obligation-to-income (DTI) ratio to select the maximum financial count you could qualify for. However, there are ways to rating a primary imagine in the place of affecting your credit rating.

1: Meeting Basic Suggestions

Just before plunge into quantity, financing manager eg me usually ask multiple secret concerns to help you make you a definite picture of everything you might be eligible for. Here’s the recommendations you’ll need to ready yourself:

- Understand Their Rating: Even as we wouldn’t make a hard credit remove during this period, having an over-all concept of your credit rating is beneficial. A high credit history generally form a lesser rate of interest and greatest loan alternatives.

- Expert Suggestion: Play with totally free borrowing from the bank overseeing units to acquire an offer of rating. Try using a score with a minimum of 700 to be eligible for extremely antique funds. Explore Myfico to really get your results. Loan providers usually eliminate the Equifax Beacon 5.0, Experian Fico II and Transunion Fico Vintage 04. We pull all 3 ratings then make use of the middle score. You can buy such scores instead of and work out a challenging query and you may therefore probably reducing your score! I’m in no way associated with myfico,com.

- Monthly Earnings: Were most of the resources of money, such as for example paycheck, incentives, and extra money.

- Month-to-month Expenses: Record out bills, in addition to vehicles repayments, bank card minimums, student loans, and youngster help. This will help you evaluate your own DTI ratio and you may complete economic wellness.

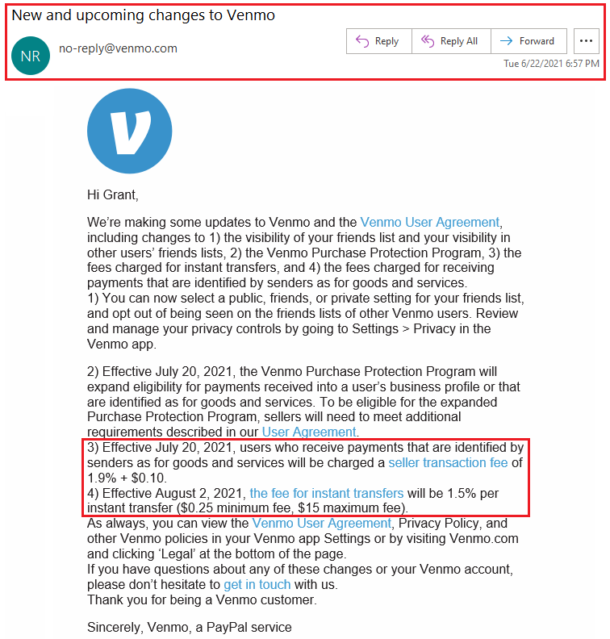

Step 2: Understanding Mellow Credit score assessment against. Difficult Credit assessment

In terms of checking your credit when you look at the financial pre-certification processes, it is critical to comprehend the difference between a smooth credit score assessment and a difficult credit assessment . Each other suffice various other purposes and also have distinct affects on your borrowing from the bank score.

- No Impact on Credit rating: A softer credit assessment, labeled as a great “delicate inquiry,” does not connect with your credit rating. It provides a general post on your credit score instead delving on the what.

- When it’s Made use of: Mortgage officials have a tendency to use flaccid checks having pre-qualification. It includes an idea of their creditworthiness and you may possible mortgage options instead of starting a complete app.

- Benefits: While the a flaccid query wouldn’t appear on your credit history, it is a terrific way to estimate just how much you could be considered for instead adversely impacting your own score.

- Influence on Credit score: An arduous credit assessment, otherwise “tough query,” relates to a thorough report about your credit score, that will briefly lower your credit score by several circumstances.

- If it is Put: Difficult inspections was presented when you officially submit an application for a mortgage, bank card, or other financing. Lenders you prefer that it more information while making a final credit choice.

Having websites first pre-qualification , we recommend you start with a flaccid credit score assessment to evaluate your selection. Once you’re happy to move on and look at home, we can go-ahead having a difficult credit score assessment to execute the new financing terms and conditions.

Step 3: Calculating Your debt-to-Income Ratio (DTI)

Probably one of the most vital components of mortgage certification is the debt-to-earnings ratio . Loan providers typically choose an excellent DTI away from forty five% or down. The following is a simple formula in order to imagine: