Home insurance was a means to cover forget the on your own USDA-secured home regarding fires, disasters, crashes, theft, or any other categories of wreck. Its probably one of the most earliest a means to safeguard your property out-of absolute and you may guy-made catastrophes.

It is also anything USDA loan providers requires. Homeowners insurance protects their equity, which customers never completely very own before the financing are reduced for the full.

But home insurance is not just a good idea because it’s called for. Property is among the greatest buy you can easily actually generate, and it also only tends to make sense to help you ensure on your own facing losses.

There are numerous different types of insurance rates, nevertheless two main categories one USDA borrowers stumble on is residents (either titled hazard) insurance and flooding insurance rates.

Possibilities otherwise Homeowners insurance

This is basically the earliest sorts of insurance rates whichever lender, along with of those backed by brand new USDA, requires that keeps before you could close.

You are going to need to establish you may have an insurance policy that you’ve pre-covered the first seasons. You will find various style of homeowners insurance regulations and you can coverages. Loan providers possess their standards for coverage, so chat to the loan manager about what needed given your specific disease.

- Flame

- Super

- Hail

- Windstorm

- Theft

- Vandalism

- Ruin off car and you may routes

- Riots and you can municipal commotion

- Volcanic emergence

- Mug breakage

Very first possibility insurance rates will not safeguards flooding or earthquakes. If you live during the a flood or disturbance-vulnerable city, you might have to take-out a special rules to guard up against people disasters.

Along with earliest issues insurance and you will flooding otherwise earthquake insurance coverage, there are americash loans Newtok numerous almost every other important type of insurance you should consider.

Investing Residents and Flooding Insurance fees

To have a great USDA mortgage, you need to have home insurance coverage towards the level of the borrowed funds otherwise exactly what it create costs to completely improve your domestic whether or not it try missing.

Keep in mind that the newest replacement pricing differs versus count your property is really worth. Essentially, the new substitute for prices will be used in your own assessment alongside the appraised worth, as well as your insurer will come up with her estimate based on the specifics of your property.

Numerous factors enter into deciding exacltly what the premium commonly be, along with in your geographical area, what insurance provider you may be playing with, what sort of visibility you earn, your own history of and make insurance coverage claims, what your residence is produced from, and how much it might pricing to change your property.

You will need to ount is reasonable. High deductibles will indicate straight down yearly premiums, however, that also mode more income with your own money till the insurance provider potato chips from inside the if you file a claim.

At the closing, you will spend the money for whole basic year’s premiums as part of the closing costs. Customers is also query manufacturers to fund that it pricing as an element of the negotiations off closing costs and you may concessions.

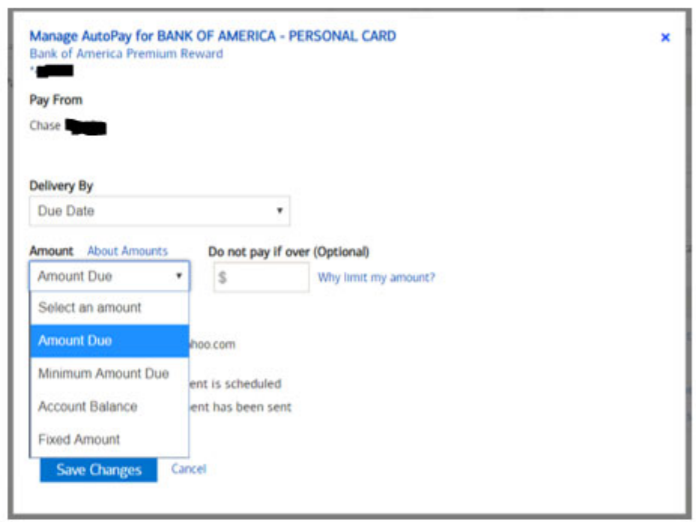

Following, you’ll generally pay a portion of this yearly costs each month inside your regular mortgage repayment. Loan providers usually escrow such funds and you can spend the money for superior for you when it is due. They will typically carry out the ditto together with your yearly possessions tax bill.

That is why you can easily may see a mortgage commission expressed due to the fact PITI, and that is short for prominent, attract, fees and insurance coverage. The individuals five issues make up the brand new payment for the majority USDA customers.

How to Receive Payment to own Loss

In the event the things happens to your residence and you ought to make an insurance coverage allege, you will end up accountable for filing the new claim together with your insurer.

The next strategies are very different by the insurance company, however, fundamentally, you’ll inform them what happened, and they’re going to distribute a keen adjuster to decide whether you’re shielded, as well as simply how much.

Then commitment is created, it’s your obligation to spend your deductible and you can negotiate together with your insurance provider if you believe like you’ve been unfairly paid.