For many home buyers, an effective fixer-top is their thought of a dream house. not, the procedure of to get a fixer-top has a lot more duties compared to services into the finest status otherwise the new structure belongings . Getting ready for the procedure boils down to creating a renovating plan, knowing what to search for while looking for postings, and you may knowledge what financial support choices are readily available.

Planning for a great Fixer-Top

Fixer-uppers require another-depending mindset. Knowing the magnitude of your methods you and your household are prepared to deal with can help to form your budget and you will your expectations in the future. With some first pricing investigation your given project, you are going to need to choose be it beneficial to order the new information yourself and you will get it done Do-it-yourself otherwise hire an expert . When testing the fresh new seas for elite group remodeling, rating certain rates in order to examine will cost you anywhere between contractors. Just remember that , along with the downpayment and you will closure fees , the expenses in a great fixer-higher purchase could potentially talk about-funds without difficulty. Analyze permitting towards you to learn how to browse any judge roadblocks on repair techniques and to top assess their schedule for your home upgrade strategies.

Shopping for good Fixer-Top

- Location: Whether you’re to find an excellent fixer-top that have intends to sell, book it, otherwise live in they, imagine their area before buying. Should you decide on the attempting to sell or leasing, location the most important factors for making a great return on your investment. So if you’re gonna reside in the fixer-upper, remember that venue could be a corner regarding your experience with the house. If you’re looking to offer sooner or later, speak to your agent to determine large Roi restorations ideas you to definitely usually pique visitors interest in your neighborhood.

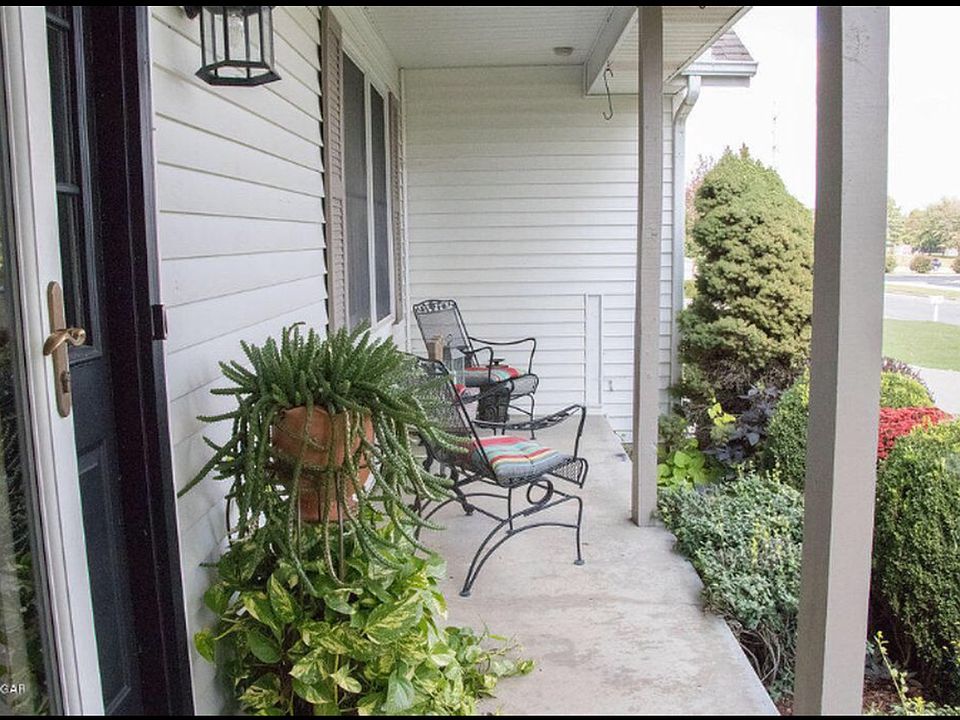

- Extent regarding Recovery: If you are searching to have an inferior measure renovation, come across postings which need cosmetic makeup products systems such as for instance this new indoor and you may additional decorate, new carpeting and you may floor, device cash quick loan Florida updates, and you may basic landscape restoration. More costly and you will inside it systems include lso are-roof, replacement plumbing system and you can sewer traces, substitution Heating and cooling solutions, and you will full-scale place remodels.

- Choosing a company for your Upgrade

- Inspections: Beyond a basic domestic inspection , which covers elements of the home such their plumbing work and you can base, think specialized monitors to have insects, rooftop experience, and you can technologies account. This will help differentiate involving the property’s slight defects and you will critical troubles, next informing your decision when the time comes to prepare a keen bring.

- How to make a deal toward a house?

Capital Selection

You’ll be thinking about different kinds of mortgages when buying a good fixer-upper, but keep in mind that repair fund especially create buyers to help you funds the house together with improvements on property to one another. A lot more consultation services, monitors, and you may appraisals are often needed in the borrowed funds processes, however they let book the task and you may resulting home worth.

- FHA 203(k): Brand new Federal Homes Administration’s (FHA) 203(k) financing are used for very ideas in the process of fixing up property. In comparison to traditional mortgage loans, they could undertake all the way down income and credit scores having licensed individuals.

- Va repair financing: Using this financing, the home improve prices are joint towards loan amount getting our home pick. Contractors working in one home improvements should be Va-recognized and you will appraisers involved in the assessment procedure must be Va-official.

- HomeStyle Financing Federal national mortgage association: Brand new HomeStyle Recovery Mortgage can be used because of the buyers to acquire an effective fixer-upper, otherwise from the people refinancing their houses to purchase advancements. Which financing together with allows luxury methods, eg swimming pools and landscaping.

- CHOICERenovation Mortgage Freddie Mac: This restoration home loan was guaranteed through Freddie Mac computer, allowing projects you to definitely bolster a house’s power to endure disasters otherwise fix wreck considering a last crisis.

When you find yourself seeking to purchase a beneficial fixer-higher, apply at a neighbor hood Windermere broker in order to see the processes and speak about exactly why are one particular feel for your requirements.