?This new Va Recovery Financing combines several of the most creative and you can glamorous features of several well-known financial applications. It provides no money off money which takes care of not merely the new newest value of the home nevertheless cost of building work and you may solutions also. This choice is intended to have slight standing and you can work done to your the house at a cost below $thirty-five,one hundred thousand, with no minimum recovery rates demands.

The latest Va Restoration Mortgage may also need to be considered for the purchases where it wasn’t part of the brand new bundle

Since the Experienced Management makes it necessary that a house satisfy minimal assets conditions so you’re able to qualify for Virtual assistant financing, this is simply not strange getting sales to-fall because of within the inspection phase. Owner may not need to buy every repairs must guarantee the domestic match the new VA’s large criteria. That have a Va Recovery Mortgage, the brand new customers might possibly move forward for the pick from a home they like, while you are borrowing from the bank the other loans must improve the difficulties which have the house or property, nonetheless which have zero downpayment.

Virtual assistant Recovery Financing Concepts

- Get and you will Refinance Possibilities

- Familiar with funds slight renovations and low-structural fixes

- There isn’t any renovation associate requirements

- Fully Amortizing Repaired Rate

- ten, 15, 20, twenty five, & 30 year term solutions

- A couple Equipment Home

- Primary Residence Only

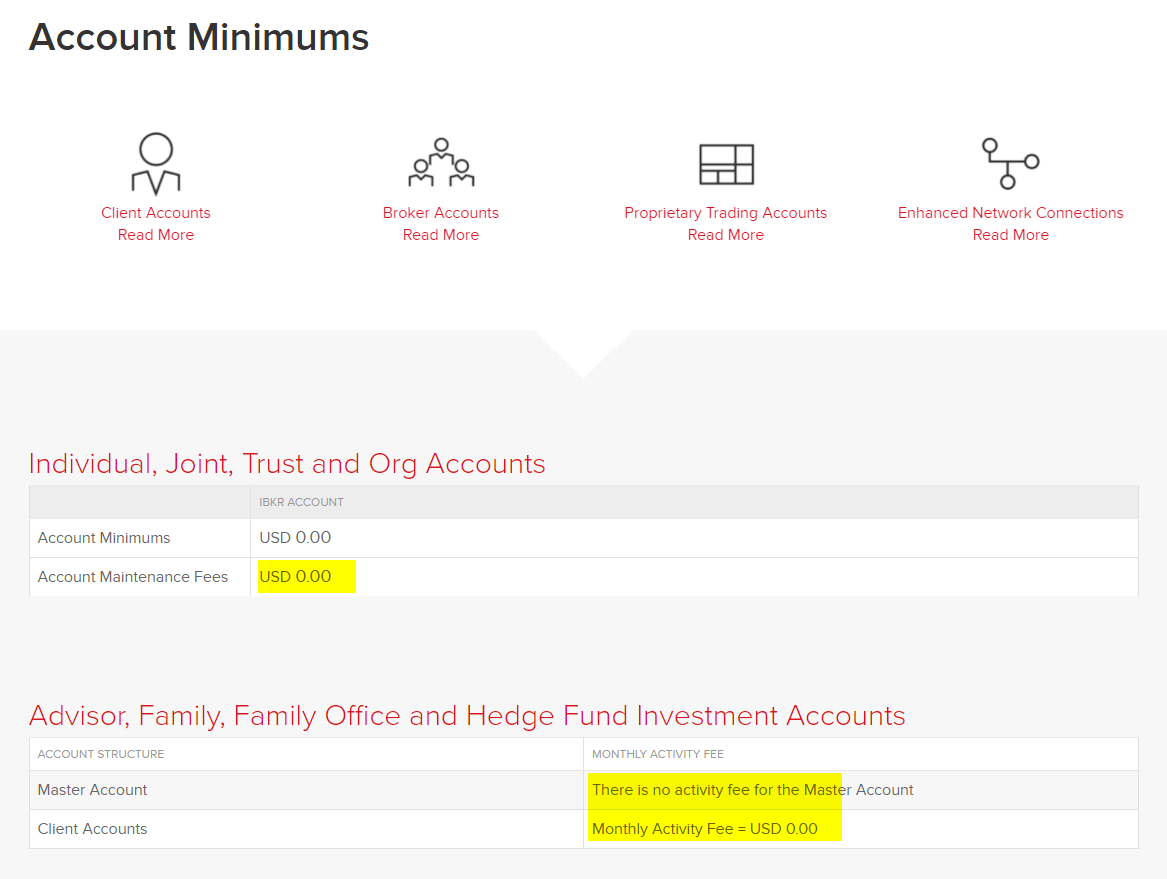

100% FinancingVA mortgages offer one of many simply no money off domestic funding options available obtainable. This is certainly a big benefit to qualifying experts, military teams, as well as their families, that will getting people as opposed to wishing decades or exhaust the offers.

Lower Financial RatesThe Virtual assistant Restoration Loan makes it possible to loans the buy otherwise re-finance off a home plus the costs away from repairs or position in a single low-rate, first-mortgage mortgage. This will promote significant coupons in comparison with a high rate second financial, playing with other types of credit such as for instance playing cards, or a house equity credit line with a variable focus speed which could boost over time.

Just like any Va loan brand new borrower should be a being qualified productive obligation member of the us military, veteran, or thriving lover. Almost every other criteria with the program is:

Va Restoration Financing Rules

- Repairs need to be small remodeling or makeup in the wild rather than among the list of ineligible solutions

- Structure should be completed inside five months out-of closure

In which conditions ‘s the Va Re also getting veterans otherwise army teams who wish to pick a fixer-higher while also taking advantage of new a hundred% financing solution open to her or him as a result of their services to easy loans to get in Mead our nation.

Military families usually disperse seem to while they undertake the newest projects in the industry of your services representative(s). Whenever transferring to a separate the main nation, especially in a preliminary schedule, it may be difficult to come across a home that meets this new needs of your own people. Seeking to get during the a certain college area, around the ft where you have the help off other military home, otherwise within this driving range regarding a spouse’s this new employer makes one thing difficult. Beginning the fresh search to include qualities searching for a few repairs or position causes it to be simpler to realize that ideal domestic.

Once the moved to the prior to it can be utilized to store new package when affairs was receive from assessment. Probably the audience have discovered a property it like, regarding perfect area, however the home check suggests that the rooftop is during you would like from fix. The new perform-be consumers may not be capable be able to pay money for work with your own money, therefore the manufacturers you will feel they might easily offer our home as-is within the market and are usually not providing to fund the expense of fixing brand new rooftop. Our home does not be eligible for Va money through to the solutions is actually complete. A Virtual assistant Recovery Mortgage could well be a great fit inside situation, allowing the newest buyers so you’re able to borrow the other loans must shell out into the roofing system performs, and you can preserving them off beginning again within their identify a good new house.

To purchase a home having a good Virtual assistant Renovation LoanWhen to acquire a home that have a Va Recovery Loan the brand new arrangements to your performs, in addition to information on the overall specialist, was examined with the most other paperwork inside the underwriting phase. An assessment will show the value of our home both prior to and you can adopting the restoration is complete. Due to the fact work is done you’ll encounter a last certification of the an excellent Virtual assistant Inspector to be sure the house fits the home requirements that is willing to getting liked by the its new customers.