Two separate money: You are going to pay a few money monthly to separate your lives loan providers. In the current on line financial vehicle-shell out industry, that’s not an issue. Only build recurring costs.

Being qualified to possess an 80-10-ten piggyback mortgage is a bit more difficult than for a basic compliant financial. This is because the next financial is considered greater risk, very is sold with highest cost and a lot more strict acceptance requirements.

And, even although you become approved for the primary financial, discover a spin the second mortgage lender would not take on the application.

The minimum credit score for a first antique home loan try 620, although some lenders want an even higher rating. Nevertheless the next lending company need good 680, 700, or even higher.

Lenders will even check your DTI. When you have significant non-houses costs, particularly high mastercard balance, a car payment, and you can a fantastic personal loans, they could see you as the high-exposure with the addition of for the a couple of casing money simultaneously debt pile.

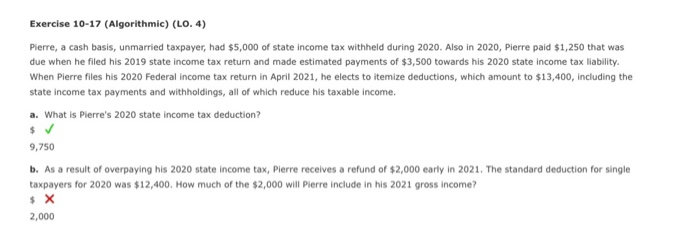

Piggyback funds compared to FHA vs Antique that have PMI

Less than was a rough comparison of three loan models chatted about. Click to locate a customized estimate for each and every alternative.

$300k Household Purchase80-10-1090% FHA90% Conv. w/PMIFirst mortgage$240,000$274,725 (incl. upfront FHA MIP)$270,000Second home loan$30,000n/an/aHas home loan insurance rates?NoYesYesHas second mortgage payment?YesNoNoThese data was estimates and analogy aim simply.

80-10-10 choice

In the event that an 80-10-10 piggyback financing is not an option for you, there are more an easy way to conserve. And there are lots of zero and you can low-down payment mortgage programs you to, as they do involve some variety of financial insurance, will be the best economic moves anyway.

A normal 97 loan, including, lets qualified homeowners to invest in a house which have 3% off. The brand new 97 means the loan-to-worthy of proportion (LTV): 97% lent and 3% down.

You are going to spend PMI towards a conventional 97 financing. However, on the other hand, it may be simpler to be eligible for one money than for an 80-10-ten piggyback financing, particularly if you possess a but not advanced borrowing or your DTI is found on the higher stop.

While the in the course of time you purchase a property, the sooner might begin to build family security, which is a primary reason behind increasing your own wealth.

Remember, PMI actually forever. You could potentially demand this be removed once you reach 20% household security, and you may have the ability to generate additional mortgage repayments if we need to end up being aggressive on your own cost timeline and you will struck 20% at some point.

When you started to twenty two%, the fresh new PMI needs drops regarding immediately; it’s not necessary to speak to your financial so you can demand it.

- USDA finance: 0% off

- FHA finance: step three.5% down

- Virtual assistant fund: 0% down getting eligible homebuyers having full entitlement work with

USDA and you will FHA financing both provides initial and you can annual home loan insurance policies conditions. Va finance lack yearly mortgage insurance fees, but there is however an initial investment commission.

80-10-10 loan providers

Not every lender is going to do an 80-10-ten mortgage. It entails gaining access to the second home loan vendor, and that specific lenders you should never. Actually fewer lenders are educated enough to book one another funds due to the procedure and intimate punctually.

80-10-10 piggyback financing Frequently asked questions

What makes piggyback mortgage loans titled 80-10-ten mortgage loans? A keen 80-10-10 piggyback financing results in: a primary financial to possess 80% of deals rate; a second lien to have ten%; and you will a good ten% down payment. The following financial piggybacks in addition earliest.

Manage piggyback funds continue to exist? Sure, 80-10-ten piggyback fund are still available. Only a few loan providers promote her or him otherwise can help you have fun with how do medical school loans work these to buy a house, so if you’re searching for this 1, ask your bank if they give it before applying. It may even be you can easily to locate a keen 80-15-5 piggyback loan, based on your own bank.